“The world of venture capital, as we know it, is changing very rapidly”

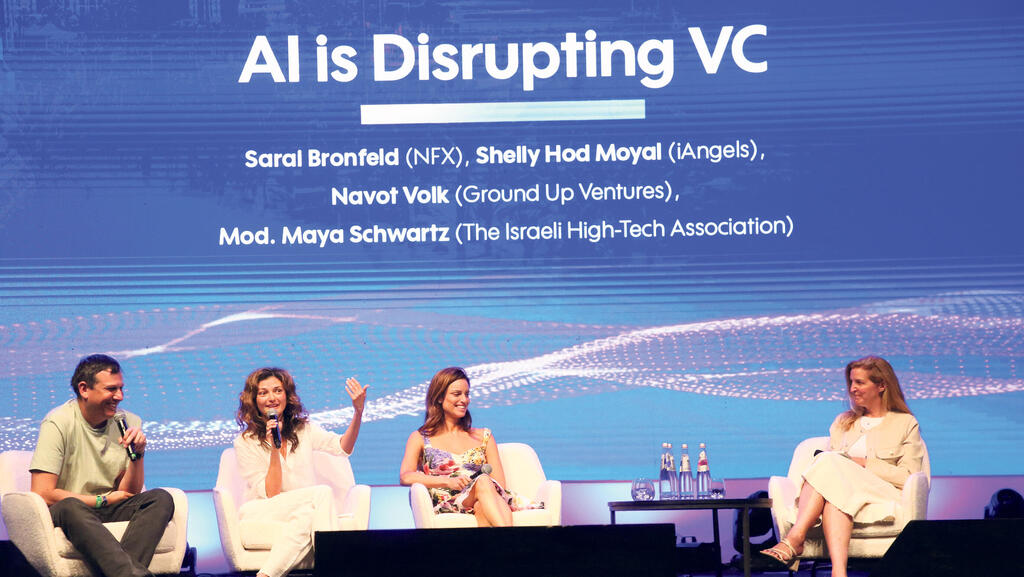

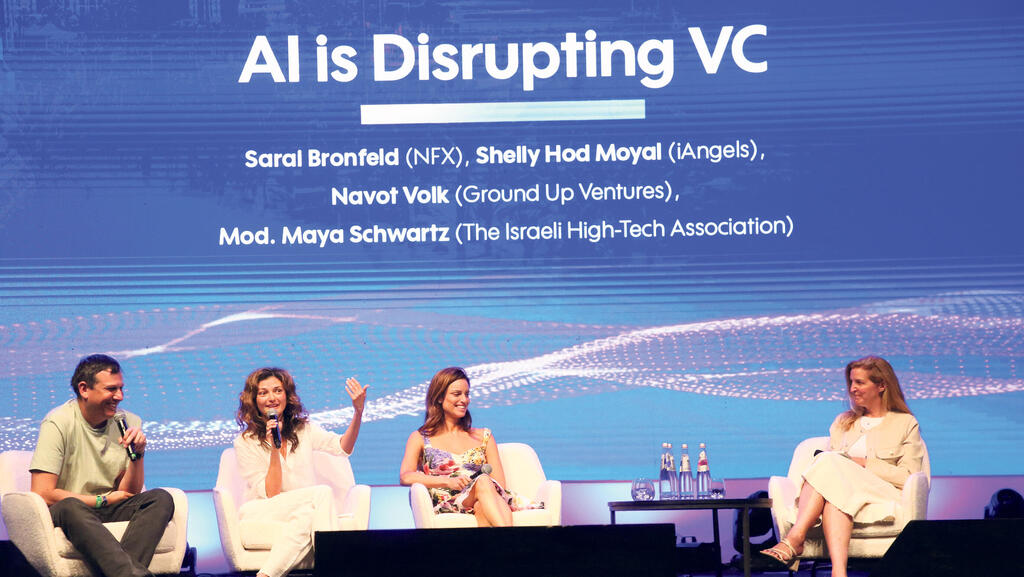

Sarai Bronfeld, a partner at NFX was speaking on a panel with Shelly Hod Moyal, a founding partner at iAngels, and Navot Volk, partner at Ground Up Ventures.

“The world of venture capital, as we know it, is changing very rapidly,” said Sarai Bronfeld, partner at NFX, during a panel at the Tech1 conference in Eilat. “The giant American funds are transforming into massive corporations, more like private equity firms. They no longer just wait ten years for a return; they actively create the market themselves.”

The panel, moderated by Maya Schwartz, CEO of the Israeli High-Tech Association, also featured Shelly Hod Moyal, founding partner at iAngels, and Navot Volk, partner at Ground Up Ventures. The discussion focused on how artificial intelligence is reshaping venture capital - from deal sourcing to decision-making.

1 View gallery

From left: Navot Volk, Sarai Bronfeld, Shelly Hod Moyal and Maya Schwartz

(Photo: Ryan Preuss)

According to Bronfeld, the rise of the secondary market is a significant sign of this transformation. “Secondary transactions, purchases of stakes in existing companies, are exploding and now total around $100 billion. These investors want to maintain control of the companies they back. This presents an opportunity for Israeli entrepreneurs to secure substantial capital.”

Is the day-to-day work of venture funds changing too?

Volk offered a measured take: “We’re summarizing meetings and analyzing materials using AI, but it hasn’t fundamentally changed how we evaluate companies.”

Bronfeld disagreed: “For us, it has made a big difference. In the past, people worried robots would replace factory workers. Today, it looks more likely that AI will replace Harvard graduates, investors, lawyers, and all the 'smart people', first. There are tens of thousands of startups out there, and only a fraction work face-to-face. When someone starts a company, they’re potentially facing 2.5 million others that may want to collaborate or compete. You need tools to quickly evaluate them. Today, you can build a product in minutes. Without AI tools, you can’t keep up.”

Hod Moyal noted AI’s practical value: “I use standard AI tools daily, but I also rely heavily on search tools to quickly gather facts. AI has made us more efficient and we’ve started using it internally as well. We’re filtering and processing information through AI-based systems.”

Bronfeld added: “We’ve taken it a step further. We’re using AI to map out potential founders before they’ve even launched companies. The system surfaces intriguing data points, courses taken at Harvard, interesting tweets, and cross-references everything into a centralized database. We only started recently, but we’re actively identifying top talent at leading U.S. universities.”

If generative AI companies can do more with less, do they still need venture capital?

Volk: “Maybe less capital is needed to get started—to build a product—but growth still requires funding. And it’s not just for development. It’s for marketing, sales, and breaking into the market. It’s great that seed rounds can be smaller, but that’s offset by the funding needed for scaling.”

Hod Moyal agreed: “The lower capital requirements remove barriers. As funds, we need to be more conservative and deliberate. We may be at a pivotal moment, like mobile in 2008. A lot is changing fast, but there are huge opportunities in both software and services. AI is disrupting nearly every technology category, and many of these disruptions require less capital.”

Bronfeld pushed back: “I strongly disagree with the call for conservatism. Now is exactly the time to make bold, strategic moves. All major funds are structured as private equity now. The old model, investing and waiting 20 years, is dying. The American mega-funds are building entire categories and reshaping markets. I still believe deeply in seed-stage investment. I don’t see the same gold-rush mentality we saw in 2021, where everyone piled into the same deals. That’s over.

“We’re still the Startup Nation, but many early-stage funds have disappeared. We need to rethink where capital is most impactful. Big companies now understand that throwing money at seed-stage startups doesn’t guarantee success. There’s still a strong case for starting with smart capital, building product-market fit, and scaling deliberately. I see too many companies that raised big seed rounds and are now stuck.”

Hod Moyal concluded: “We’re in an industry undergoing massive transformation in real time. Barriers vanish overnight. A company you backed could suddenly face ten new competitors out of Silicon Valley. We have to stay agile and diversified, while making more calculated, thoughtful investments.”