The SaaS reckoning reaches private equity

AI-driven repricing turns once-coveted software portfolios into a growing liability.

The SaaS (Software as a Service) apocalypse, even if exaggerated, is beginning to spill beyond the boundaries of software companies themselves. About three weeks ago, Orlando Bravo, co-founder of the Thoma Bravo investment fund, said that following the market declines, rare opportunities had emerged to acquire software companies. Since then, however, those “opportunities,” as Bravo described them, have become even more attractive as the sector’s stocks have fallen further, and investors are beginning to cast an anxious eye toward funds like Thoma Bravo as well.

In recent years these funds have built portfolios heavily weighted toward software companies, based on the rapid-growth thesis that dominated the market. Acquisition activity by investment funds in the software world reached more than $250 billion in 2021 alone, and over the past five years software transactions have consistently accounted for about a quarter of the total value of all fund acquisitions. Private-equity firms typically buy private companies or take public ones private, aiming to improve their business and operations, often through mergers and the use of leverage, with the goal of selling or floating them after five to six years at several times the purchase price.

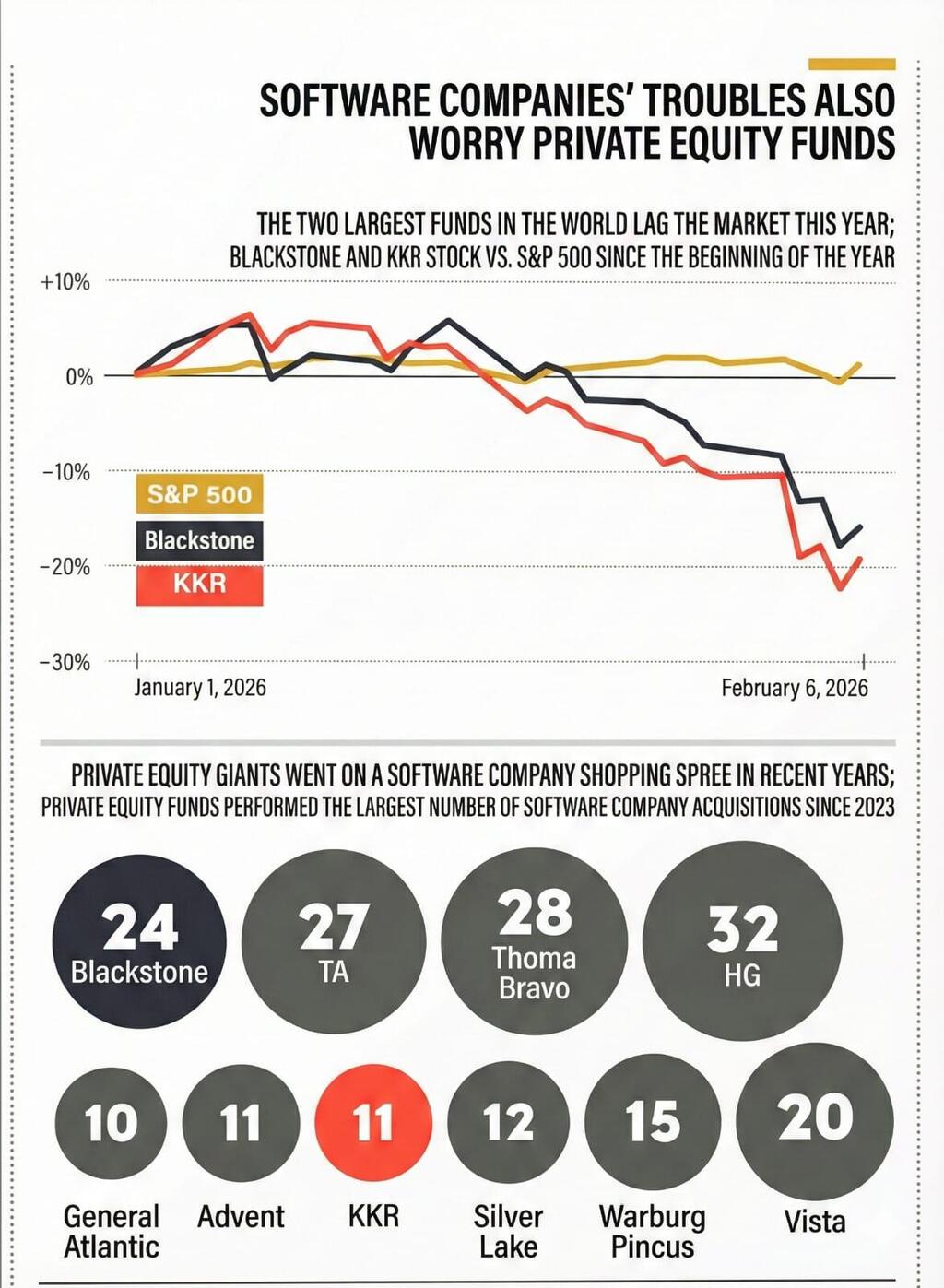

It is now unclear whether those expensive and highly leveraged deals can still generate the expected returns. This uncertainty is already visible in the share prices of publicly traded funds such as Blackstone and KKR, which have fallen more than 10% since the start of the year. At the end of the week, research firm PitchBook published a list of investment funds most exposed to the risk that the software model as we know it is breaking down. The list includes all the major funds active in Israel: Thoma Bravo, a well-known enthusiast of software and cybersecurity companies, has completed 28 acquisitions since 2023; Blackstone follows with 24 deals in the same period; and Advent, which recently acquired Israel’s Sapiens for $2 billion with the declared aim of turning it into a SaaS company, has carried out 11 such transactions in recent years.

Even if the SaaS sector, which has become the industry’s dominant model, is not dead, it is undergoing a painful repricing. The model relies on organizations purchasing subscriptions equal to the number of users, providing high predictability and steady growth in line with headcount. The arrival of AI and the automated agents it enables appears to undermine that logic: a digital agent can potentially replace many employees, eliminating the need for per-employee subscriptions. It is still too early to predict what the other side of this upheaval will look like, but the prevailing assumption is that SaaS will have to shift toward payment based on measurable improvements in business outcomes.

Another assumption is that young tech companies will increasingly prefer to develop many software tools in-house using “vibe coding,” programming in natural language with the help of AI. Older companies are unlikely to discard core systems, particularly central “systems of record,” but they may have less appetite for new features marketed by vendors, choosing instead to build them internally.

The implications of this revolution pose a direct threat to investment funds. Many software companies are now worth far less than the prices paid for them, and instead of being sold at a premium, they may require significant write-downs. This is already evident in collapsing valuation multiples. At the end of 2022, on the eve of ChatGPT’s launch, software companies traded at an average EBITDA multiple of 30. By the end of 2025 that figure had fallen to 22, and today the median multiple on forward profitability is only 16. Revenue multiples have dropped as well, from 10-12 times expected revenue in 2022 to about 4 times under current valuations.

The difficulty in realizing software holdings will have several consequences. The most immediate, and the one currently alarming markets, is linked to the largely American debt market that financed many of these deals. In the U.S., an estimated 20% of private credit exposure is tied to software companies, and in the banking sector there has already been a 100% jump in recent months in loans classified as “distressed” and trading below par. Last month, the volume of such debt stood at around $25 billion, compared with less than $10 billion in previous years.

For Israeli high-tech, the main threat is a decline in appetite for software companies and a fall in valuations in line with global trends, after years of numerous local exits. In the longer term, much like what happened to venture-capital funds after the 2022 crash and their weak returns, private-equity funds may struggle to raise capital for future vehicles. Even if markets are currently pricing software at peak pessimism and stocks rebound in the near future, it is reasonable to assume that fund managers are already far less eager to chase the remaining opportunities in the sector. Some will prefer to sit on the sidelines altogether, while the bolder ones will focus only on the strongest names to reduce risk, which again means less money available for exits.