The $250+ million ARR club: Israel’s most lucrative tech startups

Forget flashy valuations, these companies are winning where it counts: revenue and resilience.

What revenue threshold makes a high-tech company a success story? Until recently, an annual revenue rate (ARR) of $100 million was considered a status symbol that signaled a company was on the right track. That "right track" typically leads to an IPO on Wall Street, where today the minimum revenue threshold needed to attract serious investor attention, not just Reddit communities, is around $300 million. At that level, the expectation is that a company with a working business model should already be turning a profit.

However, as with everything in our lives lately, artificial intelligence is upending long-held assumptions and habits. Just last week, Loveable, a company that allows users to write code without programming knowledge, simply by typing prompts, announced it had reached an annualized revenue rate of $100 million just eight months after its founding. In doing so, it broke the record previously held by Israeli cybersecurity company Wiz, which had reached the same milestone in two and a half years.

Still, these cases are outliers that don’t prove a new rule. Alongside this new generation of “AI-native” startups, some of which will likely become not just unicorns but decacorns (valued at $10 billion and up), there remains a cohort of more traditional unicorns that have been maturing over the past few years. Since the tech bubble of 2021, their luster may have faded, but in the quieter aftermath of frenzied funding rounds, many have turned their focus to the real work: building viable businesses rather than just racking up valuations.

In this project, Calcalist highlights Israeli tech companies that have passed the $250 million revenue threshold, a level that positions them for the next critical phase: reaching profitability. This, in turn, will better equip them to remain independent or pursue the path to a public offering.

These companies represent a different breed. They haven’t rushed to sell themselves to tech giants, and haven’t yet gone public let some of them may have hoped to do by now, they all share one key trait: they generate significant, recurring revenue in the hundreds of millions of dollars annually.

Interestingly, most of the companies on this list are not recent startups. Coincidentally, or perhaps not ,the majority were founded around 2015, making them about a decade old. Many have also faced serious challenges along the way. Rapyd saw its valuation fall from over $12 billion to $4.5 billion today. Via abandoned its consumer transportation model and pivoted to enterprise software, becoming a major provider for public transit systems. Navan had to reinvent its business entirely after the COVID-19 pandemic decimated business travel, and it is now the closest among Israeli unicorns to achieving an IPO.

In 2020 and 2021, the market was euphoric. Nearly every company that raised funds achieved a $1 billion valuation. But while valuations were always publicly celebrated, revenue figures remained one of the industry’s best-kept secrets. As for profits, those are less secretive, mostly because they rarely exist.

In presenting these success stories, it's also important to acknowledge the notable absentees. Several unicorns that once boasted valuations exceeding $5 billion, like Tipalti and Fireblocks, are missing from the list. Their absence underscores the gap between inflated valuations and actual business performance. It also explains why so few unicorns in Israel, and globally, have managed to go public: the public markets apply far more realistic valuation metrics.

A prime example is the story of Riskified and Forter. Riskified went public at a valuation of around $3 billion but now trades below $1 billion. Forter, which has stayed private, retains a $3 billion valuation despite generating less revenue than Riskified. The small number of companies that have managed to surpass the $250–300 million revenue threshold highlights the extent to which venture capital investments were driven not by sound business fundamentals but by FOMO, the fear of missing out on the next big thing.

The result? A growing wave of mergers and acquisitions aimed at “cleaning up” portfolios bloated with overvalued, underperforming companies.

Moon Active

Founded: 2011

Annual Revenue: $2 billion

Capital Raised: $10 million, $420 million (secondary)

Latest Valuation: $5 billion

Employees: ~2,200

Moon Active is currently the most successful Israeli company in terms of revenue, even though it doesn’t develop AI capabilities or manufacture chips. Instead, it owes its meteoric rise to a single game: Coin Master, which generated around $1.4 billion in one year. Although Moon Active has released other games, Coin Master remains its primary cash cow.

Founded in 2011 by Samuel Albin, the company has operated with a high degree of secrecy. Its success stems from a combination of clever monetization and addictive gameplay. Coin Master is free to download, with most revenue generated through in-app purchases. Players buy virtual coins, spins, and resources to speed up their progress, build villages, and engage with others in attacks and defenses.

The game’s core is a simple slot machine mechanic that grants players rewards, attacks, or defenses. This simplicity, paired with social interactions like attacking friends’ villages or requesting help, fosters community engagement and drives spending.

Moon Active invested heavily in user acquisition and advertising across multiple platforms, allowing Coin Master to become a global phenomenon. The company raised just $10 million in primary funding. The remainder, hundreds of millions of dollars, was secondary funding used to buy shares from employees and founders. The last known valuation, in a $300 million secondary round, was $5 billion, though it is believed to have increased significantly since.

VAST Data

Founded: 2016

Annual Revenue: $1 billion

Capital Raised: $380 million

Latest Valuation: $9 billion

Employees: Fewer than 1,000

VAST Data is perhaps the best-kept secret in Israeli high-tech, but if everything falls into place, it could become the sector’s biggest success story, surpassing even Wiz, which was recently sold to Google for $32 billion. The company is currently in talks to raise capital at a valuation of $25 billion, and persistent rumors suggest it may even be acquired for more than $30 billion.

The most likely buyer? Nvidia, which already uses VAST’s platform for high-speed data storage and retrieval. Jensen Huang, Nvidia’s founder and CEO, has repeatedly praised the Israeli startup and its team. At the COMPUTEX exhibition in Taiwan a few months ago, Huang dedicated a significant portion of his keynote to showcasing VAST’s technology. And at the end of 2024, he recorded a 10-minute podcast with Renen Hallak, VAST's co-founder and CEO, to discuss the future of artificial intelligence and VAST’s role in it.

But it’s not just Nvidia that’s enthusiastic about VAST. The company is tripling its revenue year over year, and is projected to hit an annualized revenue rate of $1 billion this year. Its clients include some of the world’s largest banks, Pixar, Elon Musk’s AI company xAI, and many others, often at Nvidia’s recommendation. Nvidia also became a shareholder in VAST during its penultimate funding round in 2021.

Unlike many of its peers, VAST has already achieved positive cash flow. This financial milestone is partly the result of lean operations and disciplined cost control. The company employs fewer than 1,000 people, including about 300 in Israel.

VAST’s core innovation lies in how it handles data storage. Its technology allows organizations to store and retrieve unstructured data, such as emails, customer service requests, multimedia files, and PDFs, information that tends to accumulate chaotically but often represents an organization’s true institutional knowledge.

When VAST was founded in 2016, its decision to rely on flash memory was bold and unprecedented. At the time, flash memory was largely reserved for small, high-priority datasets due to its high cost. Traditional enterprise systems avoided flash for broader use because it was considered too expensive for large-scale storage.

Rapyd

Founded: 2015

Annual Revenue: $1 billion

Capital Raised: $1 billion

Latest Valuation: $4.5 billion

Employees: 1,400

Rapyd is one of Israel’s largest private fintech companies. In March of this year, to complete the acquisition of PayU, the company raised $500 million, mostly through equity, with a smaller portion in credit. The funding round valued Rapyd at $4.5 billion, a notable decrease from its $10 billion valuation in 2021.

Following the merger, estimates place Rapyd’s annual revenue at around $1 billion. Total capital raised to date also stands at approximately $1 billion. The company currently employs 1,400 people, including 400 in Israel and a significant team in Dubai.

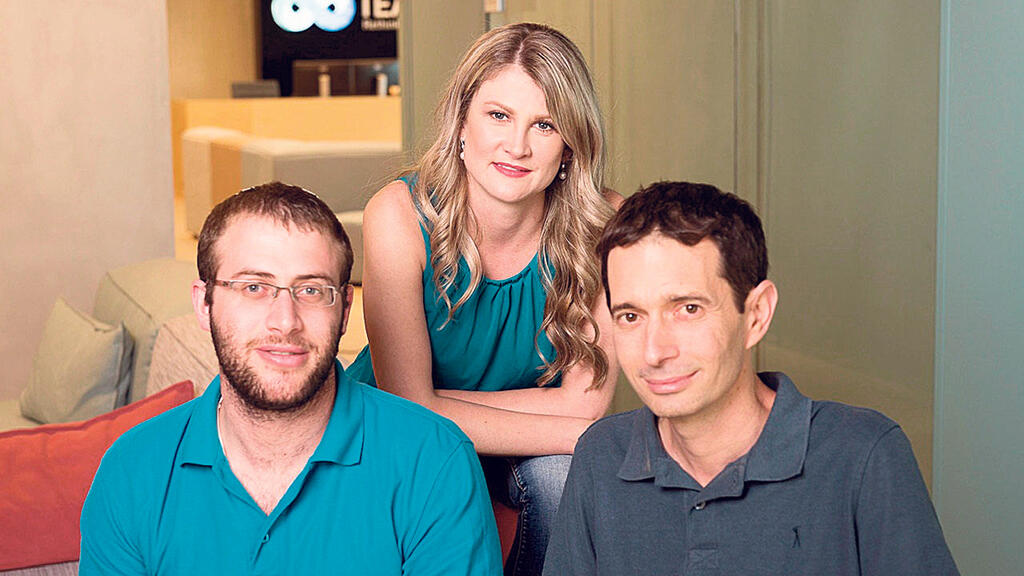

Founded in 2015 by Arik Shtilman, Arkady Karpman, and Omer Priel, Rapyd provides an international payments platform for businesses and consumers, enabling bank transfers, digital wallet transactions, and cash payments. In 2022, during the peak of the tech boom, Rapyd became Israel’s most valuable private tech company in a secondary transaction that pegged its valuation at $15 billion.

Last week, the Israel Securities Authority received a payment license to operate in Israel. The company intends to issue its own credit cards, which would place it in direct competition with major Israeli credit card providers like Isracard and MAX. Rapyd has also expanded its local presence by becoming a long-term sponsor of the Maccabi Tel Aviv basketball team.

Wiz

Founded: 2020

Annual Revenue: $1 billion

Capital Raised: $2 billion

Latest Valuation: $32 billion (as per Google deal)

Employees: ~1,800

Since its founding, the cybersecurity company Wiz has shattered nearly every possible record. It raised more capital than any other Israeli startup, reached $100 million in annual revenue within just 18 months, and is on track to hit a $1 billion annual revenue run rate this year, only five years after its launch.

This meteoric rise culminated in the largest exit ever for an Israeli company: a $32 billion acquisition agreement by Google earlier this year. It is also the largest sale of a venture-backed company globally since Facebook’s $19 billion purchase of WhatsApp in 2014.

As the deal with Google has not yet closed, Calcalist continues to classify Wiz as an Israeli company for reporting purposes. Once finalized, Google intends to integrate Wiz’s CNAPP (Cloud-Native Application Protection Platform) into every cloud deal it makes, a strategic move meant to strengthen its position in cloud security.

Wiz’s main advantage lies in the simplicity and effectiveness of its security platform, which safeguards everything connected to a corporate cloud environment and helps prevent cyber incidents. Today, half of the Fortune 100 companies use Wiz’s cloud security solutions, alongside government agencies and early-stage startups.

Wiz is widely recognized as a “cloud-native” cybersecurity company, meaning it was built from the ground up for the cloud. While the company once aspired to go public on Wall Street with a potential valuation of $100 billion or more, Google’s offer was simply too compelling to decline.

Navan

Founded: 2015

Annual Revenue: $750 million

Capital Raised: $2 billion

Latest Valuation: $9.2 billion

Employees: 2,500

Navan, formerly known as TripActions, is already taking concrete steps toward a Wall Street IPO, which, if successful, would be one of the largest ever for an Israeli-founded company. Although the scope of the offering has yet to be disclosed, Navan confidentially filed for an IPO once before, around three years ago, at a valuation of $12 billion. That attempt was shelved due to the collapse in tech stocks.

Since then, Navan has experienced accelerated growth: from $500 million in revenue in 2024 to $750 million in 2025, with expectations to cross the $1 billion mark next year. Market sources believe that the company wouldn’t be pursuing the IPO again unless it expected a valuation above $10 billion.

Founded in 2015 by Israelis Ariel Cohen and Ilan Twig as an American company, Navan has raised over $2 billion in equity and debt. Its backers include top-tier U.S. venture firms such as Andreessen Horowitz, Lightspeed, and Coatue.

Navan offers a platform for planning business travel, booking flights and hotels, and managing and reimbursing expenses. The company faced serious challenges during the COVID-19 pandemic, which devastated the business travel industry. However, it rebounded by shifting focus to expense and budget management tools.

Navan has thousands of customers, including Lyft, Zoom, Netflix, and Unilever. It employs around 2,500 people globally and established a significant R&D center in Israel four years ago. Until then, most of its development was done in Palo Alto, with another major hub in Amsterdam.

AppsFlyer

Founded: 2011

Annual Revenue: $400 million

Capital Raised: $300 million

Latest Valuation: $2 billion

Employees: 1,300

AppsFlyer was founded in 2011 by Oren Kaniel and Reshef Mann and has emerged as a global leader in mobile attribution and marketing analytics. The company’s most recent significant funding round, held in 2020, valued it at $2 billion.

Its investors include General Atlantic, Salesforce Ventures, Goldman Sachs Growth Fund, Qumra Capital, DTCP, Pitango Growth, and Trend Forward Capital. In 2024, AppsFlyer reported annual revenue of approximately $400 million, all with just $300 million raised over its lifetime.

AppsFlyer’s platform enables marketers, app developers, and advertisers to measure the effectiveness of campaigns and understand user behavior. It tracks the source of app installs, in-app activity, and purchasing behavior, offering insights into campaign performance while detecting and blocking fraud such as fake clicks and bot traffic.

Via

Founded: 2012

Annual Revenue: $350–450 million

Capital Raised: $1 billion

Latest Valuation: $3.5 billion

Employees: 1,100

Via was founded in 2012 by Daniel Ramot and Oren Shoval. The company originally operated a ride-sharing service in New York but has since pivoted to developing smart software for public transportation systems. In Israel, it previously operated the Bubble transit service, which was eventually discontinued.

Via recently filed a confidential prospectus for an IPO, the second such attempt after a 2021 effort was abandoned due to market conditions. With revenues now between $350 million and $450 million, the company hopes the time is right to go public.

Via has raised $1 billion to date. Its investors include 83North, Exor, Pitango, Janus Henderson, CF Private Equity, Planven, RiverPark Ventures, and ION Crossover Partners.

Via’s core offering is a platform that transforms outdated, fragmented public transportation systems into streamlined, data-driven networks. Its clients include cities, counties, and public transit agencies in over 30 countries. The platform helps reduce operating costs and improve the passenger experience by integrating various modes of transport into a single, intelligent system.

DriveNets

Founded: 2015

Annual Revenue: $250 million

Capital Raised: $587 million

Latest Valuation: $2.5 billion

Employees: ~450

Israeli communications company DriveNets recently made headlines when American telecom giant AT&T invested $650 million to purchase shares from employees and existing investors, becoming one of the company's largest shareholders.

DriveNets was founded in December 2015 by Ido Susan and Hillel Kobrinsky, and it builds networks based on a cloud-native infrastructure model. Susan previously founded Intucell, which was acquired by Cisco in 2013 for $475 million, while Kobrinsky founded Interwise, which was sold to AT&T in 2007 for $121 million.

The company’s estimated annual revenue is approximately $250 million and is experiencing strong growth. DriveNets has recently announced several major, mostly long-term, agreements. These include a strategic partnership with Japanese telecom giant KDDI, in which DriveNets will assist in accelerating the deployment of an open network architecture across Japan’s national infrastructure. In the U.S., Comcast has also announced it will implement DriveNets’ technology at the core of its national network. Additional deals have been signed with Europe’s Radisys and Japan’s NESIC.

To date, DriveNets has raised $587 million across four funding rounds. In its most recent round in August 2022, the company raised $262 million at a valuation of $2.5 billion. Key investors include Bessemer Venture Partners, Pitango, D1 Capital, Atreides Management, and Harel Insurance Investments.

Minute Media

Founded: 2011

Annual Revenue: $300 million

Capital Raised: $260 million

Latest Valuation: $2 billion

Employees: ~500

A little over a year ago, Minute Media made headlines around the world when it emerged as the surprise winner in the race to acquire the publishing rights to the iconic American magazine Sports Illustrated. Although the Israeli unicorn had already made a long string of acquisitions, this was its most high-profile move to date, largely because Sports Illustrated is a household name far beyond just sports fans.

The acquisition was also seen by some as a surprising move, a sort of “step backward” for a high-tech company suddenly finding itself in the seemingly outdated world of print magazines. But for Minute Media, the real story was never about print. It was, and remains, about the platform.

The Israeli company has developed a digital platform that enables the creation and distribution of sports content. Fans or athletes who wish to create content can log into one of Minute Media’s platforms, open a user profile, and begin producing content, using either media already available in the system or uploading their own photos and videos.

Once the content is created, it is reviewed by Minute Media’s editorial team, who assess the quality of the material. When needed, especially for first-time users, they provide feedback to the creator. After passing through Minute Media’s technological processing, the content is then distributed via one of the company’s owned platforms or through content-sharing agreements with partner websites.

Today, Minute Media reaches hundreds of millions of monthly users, who collectively generate tens of thousands of content pieces each month, in multiple languages.

Gong

Founded: 2015

Annual Revenue: $300 million

Capital Raised: $600 million

Latest Valuation: $7.2 billion

Employees: Over 1,000

For a brief moment in the summer of 2021, Gong became the most valuable private tech company in Israel after completing a fundraising round at a valuation of $7.2 billion. Since then, however, the company has maintained a relatively low profile, with no further fundraising rounds. At the time of that round, Gong's revenue was estimated at around $100 million. The year 2023 proved to be particularly challenging, but the rise of artificial intelligence brought Gong back into the spotlight.

By early 2024, Gong had reached an annual revenue rate of $300 million, with a growth rate estimated between 25% and 30%, largely driven by the proliferation of AI applications.

Now in its ninth year since launching commercial operations, Gong, known for its AI-driven business intelligence platform tailored to sales teams, has found its way into four of the Fortune 10 companies, including Google. While customer budgets still haven’t fully recovered to pre-2021 levels, Gong has taken the opportunity to strengthen its internal sales processes.

Gong founder and CEO Amit Bendov told Calcalist that nearly 90% of companies developing large language models (LLMs) use Gong to support their B2B sales efforts. The number of clients generating seven-figure annual deals more than doubled in 2024.

Although Gong integrated AI from the start, its leaders admit that early messaging around it often discouraged or even frightened potential customers. Today, AI is a must-have, and Gong’s software offers deep automation: it handles large parts of customer communication, tailors messaging to customer needs, and prepares sales teams for meetings using AI-generated insights.

Gong has also built a forecasting product that gives sales reps data-backed predictions based on open deals and email activity. It estimates quarterly outcomes, shows how reps are tracking against targets, and offers recommendations for closing performance gaps.

While not yet profitable, Gong is approaching that milestone. Management has also hinted at an IPO, though it is not expected within the next two years.

Redis

Founded: 2011

Annual Revenue: $300 million

Capital Raised: $357 million

Latest Valuation: $2 billion

Employees: ~1,100

Redis, one of Israel’s original unicorns, started with the open-source database engine created by Yiftach Shulman and Ofer Bengal in 2009. The company formalized in 2011 and has since raised capital from major investors, including SoftBank.

Although both founders have stepped back, Bengal three years ago and Shulman more recently, an American CEO now leads the company toward its long-planned IPO. Redis aimed to go public in 2021 at a $4–5 billion valuation, but the plan was derailed by market turmoil.

Investor impatience is growing. In 2023, Viola and Tiger Global sold $200–300 million worth of shares in one of the largest secondary deals in Israeli tech.

Redis reported $300 million in revenue in 2024, a 25% year-over-year increase. Losses also shrank from $267 million in 2022 to $176 million in 2023. With the IPO window reopening, Redis is likely to renew its public offering plans soon.

Snyk

Founded: 2015

Annual Revenue: $300 million

Capital Raised: $1.32 billion

Latest Valuation: $7.4 billion

Employees: ~1,000

Snyk is a quiet giant in the Israeli cybersecurity ecosystem. Founded in 2015 by Guy Podjarny, Assaf Hefetz, and Danny Grander, the company specializes in securing code and cloud infrastructure. Headquartered in Boston, it maintains a strong presence in both Tel Aviv and London.

Snyk offers a developer-first security platform that helps identify and remediate vulnerabilities throughout the software development life cycle (SDLC). The company has raised $1.32 billion across 17 funding rounds, with its largest round, a $397 million Series F, completed in September 2021.

Despite its impressive funding and valuation, Snyk has faced headwinds. It conducted multiple rounds of layoffs in recent years, some affecting hundreds of employees. Co-founder Guy Podjarny has since left the company and launched a new startup in London, which has already raised $125 million.

As AI becomes more pervasive, it also presents new threats to cybersecurity, an area Snyk is addressing. The company recently announced efforts to secure code generated by AI, acknowledging that much of today's software is increasingly written with the help of generative tools.

In 2024, Snyk reported $300 million in annual revenue, a 25% increase year-over-year. Losses have narrowed significantly, from $267 million in 2022 to $176 million in 2023.

Mixtiles

Founded: 2016

Annual Revenue: $250 million

Capital Raised: $35 million

Latest Valuation: Not available

Employees: 100

Mixtiles, founded in 2015 by Eytan Levit and David Katz, has built a highly efficient consumer business with only 100 employees, most of whom are based in Tel Aviv. The company is best known for its flagship product, removable photo tiles that stick to walls without nails. This product alone generates $175 million in annual revenue.

The innovation lies in the proprietary adhesive that allows users to reposition the tiles without damaging walls. Mixtiles turns mobile photos into framed art, offering a user-friendly and design-conscious experience for American households.

Their second product, EasyPlant, is a line of low-maintenance potted plants that reportedly live six times longer than average. It generates an additional $70 million in annual revenue and is also sold at the company’s two New York retail stores. Mixtiles’ newest product, Oasis, introduces smart lighting and is beginning to contribute to revenue.

The company envisions itself as a future home innovator. Its next project aims to reinvent music listening in domestic settings. Mixtiles has remained profitable for several years and self-funds new products and marketing, avoiding additional capital raises. It has raised just $35 million to date from investors including 83North, C4 Ventures, and Greenfield Partners. Daily operations are led by CEO Shay Eyal.

Claroty

Founded: 2015

Annual Revenue: $250–300 million

Capital Raised: $740 million

Latest Valuation: $2.5 billion

Employees: 500+

Claroty operates in a high-stakes niche: cybersecurity for essential enterprises and critical infrastructure. It is one of the fastest-growing startups in Israel. In 2023, the company surpassed $100 million in annual revenue, and over the past three years, revenue has quadrupled.

The company’s growth trajectory accelerated significantly following its acquisition of Medigate for $400 million in 2021. The deal, led by CEO Yaniv Vardi, expanded Claroty’s footprint in medical cybersecurity, one of the most sensitive segments of the infrastructure security market.

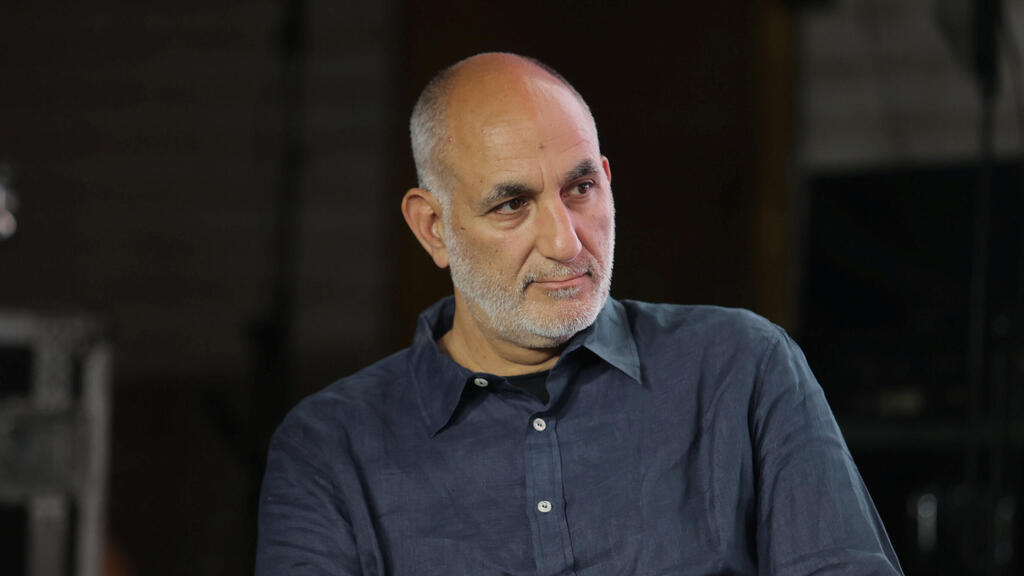

Claroty was originally incubated by Team8, a venture group that doesn’t just invest in startups, it helps create them. Among the company's prominent backers is former Mossad chief Yossi Cohen, who led Claroty’s 2021 $400 million funding round in his role as head of SoftBank’s operations in Israel.

Today, Claroty serves over 1,000 customers, including roughly a quarter of the Fortune 500. Demand for its solutions is expected to increase amid growing geopolitical instability and rising cyber threats targeting infrastructure.

Unlike other sub-sectors of cybersecurity, the critical infrastructure market is characterized by higher technical barriers and less saturation. Although Claroty has been relatively quiet since its large funding round and acquisition, insiders suggest it is preparing for a Wall Street IPO within the next two years. Another significant acquisition may come before that.

Cato Networks

Founded: 2015

Annual Revenue: $250 million

Capital Raised: $1.1 billion

Latest Valuation: $4.8 billion

Employees: Over 1,000

Cybersecurity company Cato Networks is the third major success story from serial entrepreneur Shlomo Kramer. His first was Check Point, followed by Imperva, which went public on the Nasdaq and was later sold to Thoma Bravo for $2 billion. Now, Kramer aims to make Cato his most successful venture yet.

While the company’s planned IPO has been delayed, it recently raised $360 million at a valuation of $4.8 billion. Cato is credited with inventing a new category in remote connectivity and cloud security called SASE (Secure Access Service Edge). According to Gartner, the SASE market is expected to grow at an average annual rate of 26%, reaching $28.5 billion by 2028. However, the market is already crowded with heavyweights such as Palo Alto Networks, Fortinet, and Cisco.

Cato reported that it reached a $250 million revenue run rate by early 2025, following 46% year-over-year growth. Although it is not yet profitable, if it can sustain this growth and reach profitability, it will likely open the long-awaited path to a Nasdaq IPO, and possibly make Kramer a three-time IPO success story.

Forter

Founded: 2013

Annual Revenue: $250 million

Capital Raised: $525 million

Latest Valuation: $3 billion

Employees: Over 600

Forter was founded by childhood friends Michael Reitblat and Liron Damri, who previously worked together at a company acquired by PayPal. There, they were surprised to discover that fraud prevention was still largely a manual process. As online commerce exploded, they realized there wouldn’t be enough human reviewers to keep up.

Today, Forter handles transaction verification for major online platforms such as fashion retailer ASOS and travel site Priceline. Fraud prevention is complex: websites and credit card companies are constantly under attack, yet excessive scrutiny of transactions can drive away legitimate customers.

Virtually every online shopper has experienced frustration during prolonged identity verification. Striking the right balance is Forter’s biggest challenge. Unlike many competitors, Forter’s system is entirely AI-driven and analyzes historical transactions to make fraud decisions. As a result, 99% of approvals or denials are made in less than a second, and the company claims a lower false-rejection rate than its rivals.

Forter’s main competitor is Israeli company Riskified, which went public in 2021 at a $3.3 billion valuation but has since dropped to around $900 million. Forter, meanwhile, has not yet gone public and remains valued at $3 billion based on its last funding round, despite having lower revenue than Riskified. As long as Riskified trades at depressed levels and isn’t acquired (there are rumors it is up for sale), Forter will likely hold off on its own IPO to avoid a disappointing valuation.

Armis Security

Founded: 2015

Annual Revenue: $250 million

Capital Raised: $737 million

Latest Valuation: $4.5 billion

Employees: 850

Armis Security was technically sold in 2020 for $1.1 billion to Insight Partners and Google’s investment arm. However, the acquisition mainly represented a shareholder transition, and the company continued to grow under the leadership of co-founders Yevgeny Dibrov and Nadir Izrael.

Over the past year, Armis acquired three companies, including two Israeli startups, Silk Security and Autorio, adding tens of millions in revenue and helping push its sales run rate to $250 million by the end of 2024. That number is expected to double by 2026, with projected revenue of $500 million.

Armis's latest valuation was $4.5 billion in a secondary transaction, setting a high bar ahead of a planned IPO in 2026. Its customer base includes the U.S. Postal Service, United Airlines, Colgate-Palmolive, Mondelez, and more.

The Armis platform helps organizations visualize, secure, and manage their most critical assets, from IT systems and OT environments to medical devices, cloud infrastructure, source code, and software. To date, the company has raised $737 million from investors including General Catalyst, Alkeon Capital, Brookfield, Georgian, Insight Partners, CapitalG, and One Equity Partners.

HiBob

Founded: 2015

Annual Revenue: $250–300 million

Capital Raised: $574 million

Latest Valuation: $2.7 billion

Employees: 1,300

HiBob, which will celebrate its 10th anniversary this year, has developed a modern employee management platform that generates $250–300 million in annual revenue, a significant achievement in a highly competitive field dominated by enterprise giants like Workday.

The company was founded by Ronni Zahavi, who has served as CEO since its inception, and Israel David, who leads as CTO. To date, HiBob has raised approximately $574 million across seven official funding rounds. Its most recent valuation, from a funding round in September 2023, was approximately $2.7 billion.

HiBob’s investors include Farallon Capital Management, Alpha Wave Global, General Atlantic, Bessemer Venture Partners, Battery Ventures, Eight Roads Ventures, Entrée Capital, and others.

The company’s flagship product is an enterprise human resources management platform known simply as "Bob." Its core mission is to help organizations manage their workforce more effectively, enhance the employee experience, increase engagement, and support scalable growth.

Unlike traditional HR systems, Bob is designed with a “people-first” and “culture-first” philosophy. It caters primarily to mid-sized and fast-growing companies, typically those with 100 to several thousand employees, including globally distributed teams.

Lightricks

Founded: 2013

Annual Revenue: $250 million

Capital Raised: $335 million

Latest Valuation: $1.8 billion

Employees: About 500

Jerusalem-based Lightricks rose to fame with its content editing apps, including Facetune and Photoleap, which gained widespread popularity, even among American celebrities, about five years ago. That period also marked the company's last major funding round.

Recently, however, the AI revolution has shaken up the creative software industry, forcing Lightricks to reevaluate its strategy. Filters, once a competitive differentiator, have become commoditized, prompting the company to undergo several rounds of layoffs and, more importantly, to rethink both its core product and business model.

Today, the game is no longer about simply adding visual effects or filters. The new battleground is enabling individual content creators to function like full-scale production studios. Lightricks now faces the challenge of operating in a field that has drawn the attention of nearly every major AI player.

In response, the company is working to turn this disruption into opportunity. Lightricks has begun developing its own generative AI models, designed to be more cost-effective than those offered by Google or OpenAI. It recently launched a proprietary video generation model that, according to the company, can produce visuals comparable in quality to those created with tens of millions of dollars in traditional production budgets, but at a cost of just a few cents.

Lightricks’ model is also notable for being the only open-source video generation model developed by a Western company; all other open models in the space currently originate from China.

With this announcement, Lightricks hopes to spark its own "DeepSick moment", a breakthrough that puts both the company and Israel on the global AI map. While not on the scale of large language models (LLMs), the video creation market is undergoing radical transformation driven by AI, with a total market potential estimated at $600 billion, according to Lightricks.

The key commercial shift is the ability to create video advertisements without building physical sets, using only generative AI. Even major film studios are beginning to incorporate AI-generated content into their productions, signaling the start of a new era in media creation.