21:39

Full list of Israeli high-tech layoffs in 2026

21:36

Remitly cuts 110 jobs in Israel and closes R&D hub three years after $80 million Rewire acquisition

16:41

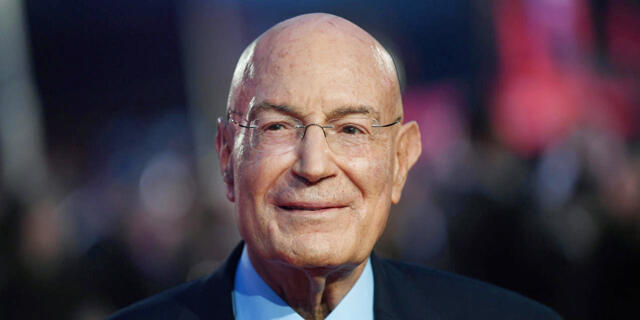

Rigas: "Energean needs more gas to compete, and to prevent a monopoly"

16:31

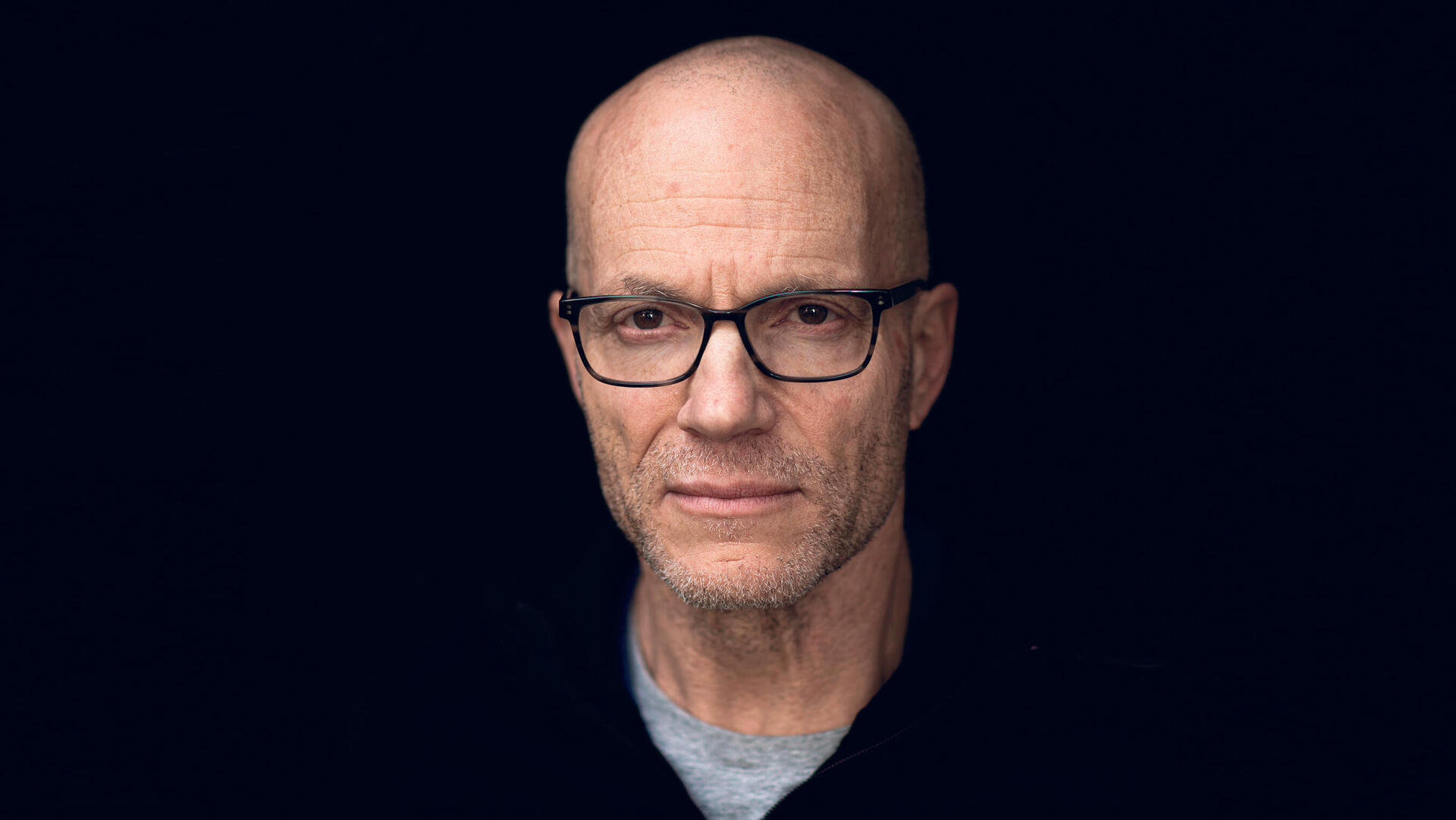

“When you raise walls around data, employees go around them”