Intel warns of risks as U.S. government takes 10% stake

Chipmaker cites threats to global sales, shareholder dilution, and regulatory constraints from Trump’s intervention.

Intel said on Monday that the U.S. government’s new 10% stake in the chipmaker could pose risks to its business, including potentially harming international sales and limiting its ability to secure future government grants.

The company outlined the new “risk factors” in a securities filing after Washington decided to convert government grants into an equity stake in Intel, an extraordinary intervention in corporate America by President Donald Trump.

Intel warned it is uncertain whether the deal could prompt other government entities to convert their existing grants into equity or to withhold future grants.

According to the filing, the U.S. will purchase Intel shares using $5.7 billion in unpaid grants from the Biden-era CHIPS Act and $3.2 billion previously awarded for the Secure Enclave program. “To the maximum extent permissible under applicable law,” Intel’s obligations under the CHIPS Act will be considered discharged, excluding the Secure Enclave program. The transaction is expected to close on August 26.

Intel said its international business may also be affected by the U.S. government becoming a significant shareholder, as this could subject the company to additional regulations or restrictions, such as foreign subsidy laws. Sales outside the U.S. accounted for 76% of Intel’s revenue in fiscal 2024, with China contributing 29%.

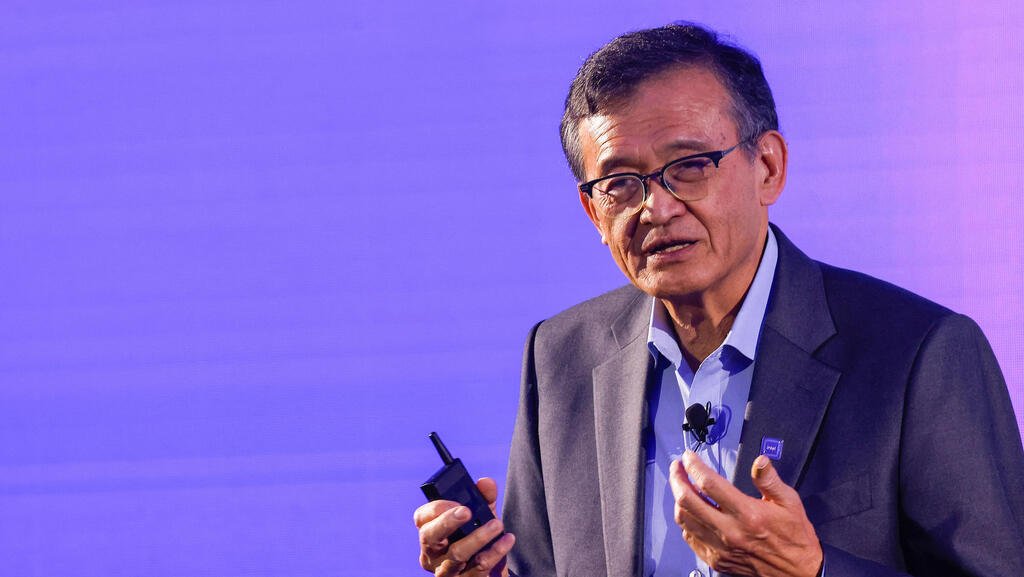

Trump’s deal with Intel followed a meeting with CEO Lip-Bu Tan, after the president had reportedly demanded his resignation over ties to Chinese firms.

Intel also disclosed that the shares issued to the government will be sold at a discount to the market price, diluting existing shareholders. The U.S. is acquiring the shares at $20.80, $4 below Intel’s closing price of $24.80 on Friday.

The filing further warned that the government’s stake not only reduces the voting power of other shareholders but also gives Washington significant influence over laws and regulations affecting Intel, which could limit the company’s ability to pursue transactions that benefit shareholders.