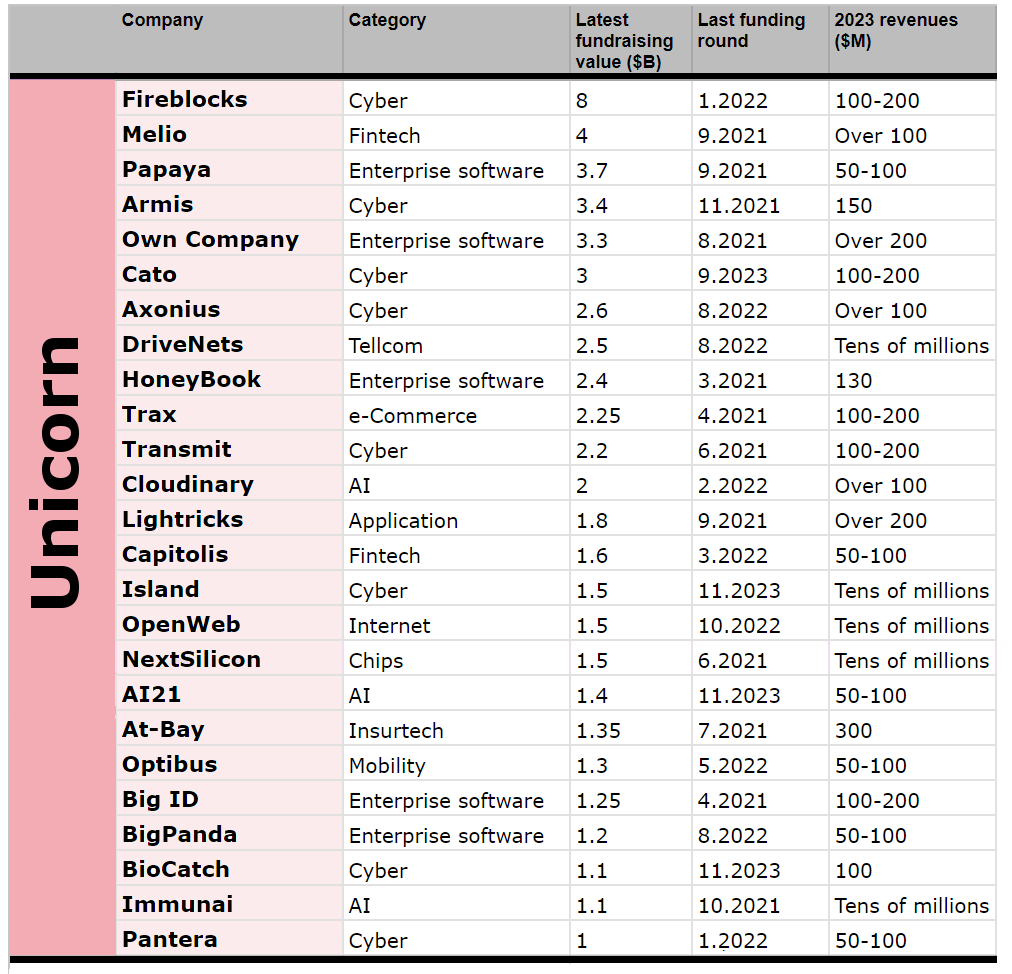

State of the unicorns 2024: Fighting for revenue

A promise of future income no longer ensures unicorn status. Interest rate increases and the recession in the industry sent investors looking for actual revenue and companies that will streamline and lay off

"I believe in the aggressive growth of the company. We will double and triple the manpower in the company." - this was the spirit of the quotes of almost every unicorn raising money a couple years back. The massive fundraising was carried out by most of the companies to the best of their ability and they recruited employees from wherever they could, both in the belief that they might need them in the future and also to show the company's investors that they are indeed working diligently to meet the aggressive growth goal. In 2022, this goal ran into an almost impassable wall: interest rates and the recession.

Until 2022, every unicorn had a belief that if it were so easy to raise $100-150 million, there is no point in bothering with small things like profits and financial efficiency. Everyone believed that the easy money would last forever, or at least for a sufficient time until they proved that they were indeed worthy of the status. The smartest of the unicorn companies collected a lot of money because they understood that it won't last forever. The less smart or less connected companies were forced to find out how hard it is today to recruit when you are a unicorn.

Many of the unicorn companies earned their status with an original and groundbreaking idea and a successful implementation of the idea that required many hours of work and successful investors. But in many unicorn companies greed of investors and sometimes also greed of entrepreneurs was revealed in the sales of shares at a very early stage of the company. Now, about two years on average after earning the coveted status of being worth a billion dollars, and some even much more than that, they are forced to do a lot to not only maintain the status, but to simply survive.

2 View gallery

Trax co-founder Yoel Bar-El (left), BiocCatch CEO Gadi Mazor

(Shaul Golan, Amit Shaal)

To achieve unicorn status somewhere in 2021, most companies presented almost no measurable economic data but future growth data that were often based on overly optimistic forecasts of entrepreneurs or general assessments of the market in which they operate. With the onset of the crisis, the word rapid growth became almost a vulgar expression and the words survival, cash and profitability became the holy grail. It was a harsh blow for all the unicorns. For some, this became the signal to really start laying off workers because the company's revenues were not close to the company's value.

A look at the list reveals that some of the unicorns earned or received the status in record speed and there are some that took many years of growth, strategic changes, change of management and more. A notable company of the second type is BioCatch, which was founded in 2011 by Avi Turgeman and the late Benny Rosenbaum. Since then, the company has gone through quite a few incarnations until, on the eve of the outbreak of the war, in a secondary deal of approximately $70 million, the cyber company was valued at a billion dollars.

For comparison, an example of a company of the first type is Noname Security, which reached the value of a unicorn at the end of 2021, about two years after its establishment, and whose revenues at the time of the recruitment in 2021 were a few million dollars. The two companies best exemplify the extremes of this world, with BioCatch getting the status now that the buyers know how much it brings in and where it is going, while the investment in Noname Security was a completely bubble investment that relied on the hope that the market would keep expanding.

A company that also took off to a great height and had to land on the ground of reality is Trax. In April 2021, the company that developed computer vision and data processing solutions for the retail world raised $640 million at a valuation of $2.2 billion. It was the biggest recruitment ever in the local high-tech industry. The company that was founded in 2010 discovered in 2022 that all the money it had raised was not enough and began vigorous layoffs during which it said goodbye to hundreds of employees.