Hospitality company Selina sacks 350 employees as it continues to bleed cash

The Israeli-founded company went public in October through a SPAC merger at a valuation of $1.2 billion, but currently has a market cap of around just $120 million

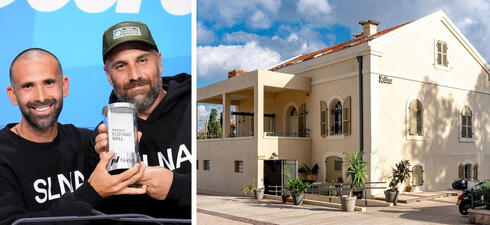

Hospitality company Selina is facing significant challenges regarding its future. Just eight months after its IPO, Selina finds itself in a position of laying off employees, halting expansion plans, and urgently seeking additional funding. As of the end of March, the company's cash balance was a mere $23 million. Today, Selina announced substantial cost-cutting measures, including the termination of approximately 350 employees, the closure of several properties, and a near-complete suspension of new hotel openings. These actions are aimed at mitigating the cash drain, which led to a substantial loss of $200 million despite generating $183 million in revenue in 2022.

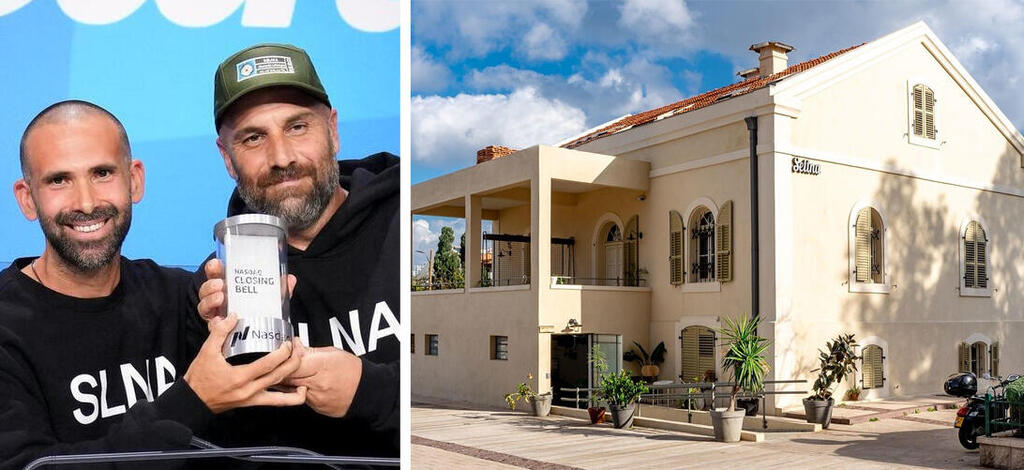

Selina, founded in 2015 by Rafael Museri and Daniel Rudasevski, went public in October through a SPAC merger at a valuation of $1.2 billion, raising $54 million. However, the company's market cap currently hovers around just $120 million.

CEO Rafael Museri spoke with Calcalist and acknowledged the need for a change in Selina's organizational culture, stating, "The market has shifted its focus from valuing growth to prioritizing profitability. Consequently, Selina's approach needs to adapt." Museri further explained that instead of pursuing frequent deals and opening numerous hotels, Selina will no longer open new properties and will even close unprofitable ones. After the current round of layoffs, Selina will retain approximately 2,000 employees, consolidating its headquarters from eight different offices into one, with some employees working remotely. This cost-cutting plan is projected to result in $5.8 million in savings starting from the second quarter of 2023, alongside a one-time expenditure of $1 million for severance payments.

In the first quarter of 2023, Selina reported revenues of $54.2 million, representing a 32% increase compared to the same quarter last year and a slight increase compared to the previous quarter. Excluding the new hotels, revenues increased by 18%. The occupancy rate rose to 57% compared to 45% in the corresponding period last year. However, the company still incurred a total loss of $30.3 million, although it improved from $38.3 million in the previous year's quarter.

The company's free cash flow before debt service was $12.6 million, down from $14.3 million in Q1 of 2022. During the first quarter, Selina did not open any new hotels and concluded the period with 118 properties and 29,600 beds. The company has begun the process of exiting from underperforming properties and has already closed five sites in Mexico, the USA, Greece, Austria, and Costa Rica. Selina intends to release an updated forecast for 2023 with a lower growth rate than the previously projected 30-40%.

Simultaneously, Selina announced a funding agreement with Global University Systems (GUS), a remote learning platform operator, to raise a total of $50 million. In the initial stage, Selina will receive $10 million from GUS, which will become a strategic investor in Selina and be granted two seats on the board of directors. It remains unclear which of the existing eight directors will step down to accommodate the new members. If Selina successfully secures an additional $20 million from other investors, GUS will provide an additional $20 million. The fundraising will involve privately issued shares at a 10% discount on the market price and convertible bonds. Selina is currently in negotiations with other investors, including existing ones, to raise $20 million. Furthermore, Selina drew $10 million from a credit line of $50 million in late May and restructured the repayment of a loan it acquired for expansion in South America when it was still a private company. As part of the restructuring, the debt was converted into Selina shares.