UVision poised for multi-billion dollar Nasdaq IPO amid loitering munitions boom

Israeli defense firm leverages HERO UAV success and U.S. Army contracts to expand globally.

UVision, the Israeli defense company owned by Aaron Frenkel, is exploring an initial public offering on Wall Street at a valuation of several billion dollars, according to sources familiar with the matter. The company has engaged JPMorgan, the world’s largest investment bank, to lead the strategic review and guide the potential IPO process. While Nasdaq is the primary target, UVision is also considering alternative foreign exchanges.

Frenkel acquired UVision in 2010 through his private company Magnus. Since 2011, the firm has been operating under his control, and for the past year and a half has been managed by Ran Gozali. Gozali, a veteran of Rafael Advanced Defense Systems, held senior positions for nearly three decades, overseeing R&D, engineering, and global business divisions across land, sea, and multidimensional warfare. He succeeded Avi Mizrahi, who served as CEO for five years. The company is headquartered in Emek Hefer, Israel.

The board of directors includes Ilan Gifman, a close associate of Frenkel; Yedidya Ya’ari, former Israeli Navy commander and ex-CEO of Rafael; and directors Yair Ramati and Yair Dubester.

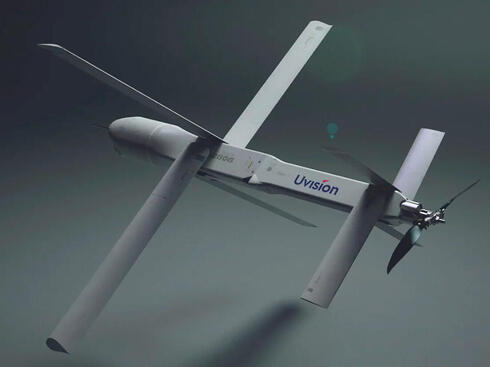

Over the past decade, UVision has grown into a global player in loitering munitions, centered on its HERO product family. HERO combines UAV capabilities with guided munitions: it can loiter over a target, collect real-time intelligence, and strike precisely once a target is identified. One key advantage is the ability to abort a strike mid-flight and return the UAV safely, reducing collateral damage and increasing operational flexibility. The HERO lineup ranges from the HERO 30, a lightweight infantry-carried system, to the HERO 120, capable of neutralizing tanks and armored targets at 60 km, and heavy models like the HERO 900 and HERO 1250 for long-range strategic missions.

The United States is UVision’s primary market. Its U.S. subsidiary, UVision USA, established a manufacturing and development center in Virginia in 2021, enabling local production to meet Pentagon procurement requirements. Another production line operates in South Carolina. UVision secured the Marine Corps and U.S. Army OPF-M program in 2021, supplying the HERO 120 integrated into armored vehicles and ships. In October 2025, UVision signed a five-year contract worth $982 million with the U.S. Army, the company’s largest deal to date, cementing its presence in the world’s largest defense market.

Outside the U.S., UVision collaborates with international partners. In Europe, it works with Rheinmetall to integrate HERO systems into military vehicles sold to NATO countries. In India, UVision participates in the AVision joint venture, producing locally for the Indian Army under government defense independence initiatives. These partnerships help the company overcome the regulatory and commercial barriers typical of defense exports.

The timing of UVision’s IPO is aligned with a global surge in demand for loitering munitions. Recent conflicts, including the Russia-Ukraine war, the Armenia-Azerbaijan war, and Israel’s wars with Hamas, Hezbollah, and Iran, have demonstrated the operational advantages of these systems. UVision’s products increasingly integrate AI for autonomous target recognition and coordinated swarm operations.

However, the company faces stiff competition from American firms such as AeroVironment, producer of the Switchblade, as well as Israeli defense giants Israel Aerospace Industries, Elbit Systems, and Rafael. Additional challenges include electronic warfare countermeasures and maintaining a stable supply chain amid rising demand.

The timing of UVision’s Nasdaq IPO is also influenced by market trends. Since February 2022, AeroVironment’s stock has quadrupled, reaching a market value of approximately $12 billion. Leonardo DRS, which merged with Israeli RADA in 2022 and listed on Nasdaq, has grown roughly 180% to a valuation of $10 billion. Silicon Valley firm Shield AI is raising $1 billion at a valuation of $12 billion, more than double its previous valuation of $5.3 billion.

Domestically, Frenkel has built a strong profile in the Israeli capital market, generating significant profits from Gav-Yam (NIS 1.2 billion) and Bank Leumi (NIS 600 million), while becoming the controlling owner of Alony Hetz and the Tamar gas field. Yet UVision remains the cornerstone of his business empire and is internationally recognized as Frenkel’s flagship venture, even as the company’s management maintains operational independence.