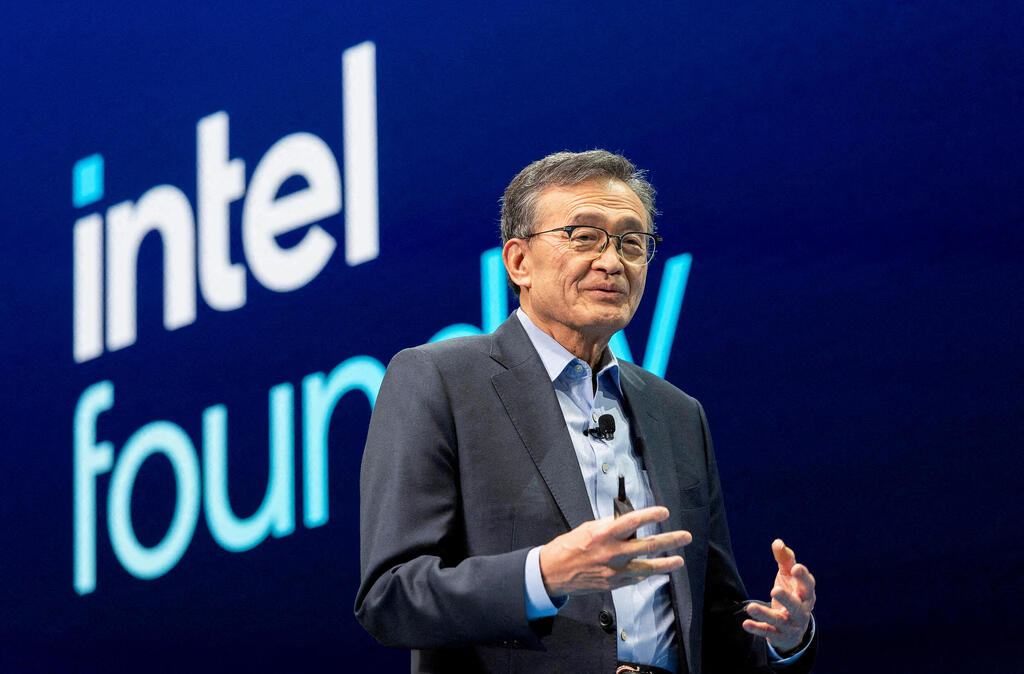

“This will not happen overnight,” Tan says as Intel confronts its limits

The Intel CEO acknowledges rising AI-driven demand while warning that supply constraints, manufacturing bottlenecks and years of underinvestment continue to limit the company’s ability to respond.

Intel ended 2025 with improving results and rising demand for its chips, but its CEO used the company’s fourth-quarter earnings call to strike a notably restrained tone. The opportunity created by artificial intelligence is real, Lip-Bu Tan said, yet Intel remains constrained by execution limits, manufacturing bottlenecks and a turnaround that is far from complete.

“This will not happen overnight, and our execution needs to continue to improve,” Tan told analysts. “We will stay humble as we address the work ahead and we will never be satisfied.”

The remarks underscored the balance Intel is trying to strike. The company is attempting to persuade investors that it is once again relevant to the AI boom while openly acknowledging that its ability to capitalize on demand is still restricted by supply constraints, yield challenges and years of underinvestment.

Intel reported fourth-quarter revenue of $13.7 billion, beating its own guidance, with earnings and gross margin also coming in above expectations. Still, Tan and chief financial officer David Zinsner returned repeatedly to the same limitation. Intel does not yet have enough supply to meet the level of demand it is seeing, particularly in data center CPUs.

“In the short term, I’m disappointed that we are not able to fully meet the demand in our markets,” Tan said. While yields on Intel’s most advanced manufacturing process are improving, he acknowledged they remain below his targets.

Those constraints will be visible in the current quarter. Intel guided first-quarter revenue to a midpoint of $12.2 billion, a seasonally weak result that executives said would have been meaningfully higher without supply limits. Zinsner described the company as operating with little inventory buffer, shipping chips almost as soon as they come off the line.

The pressure is most acute in servers. Demand for traditional CPUs is rising sharply as AI workloads move beyond training into inference, orchestration and networking. In those areas, CPUs remain essential. “The continuing proliferation and diversification of AI workloads is placing significant capacity constraints on traditional and new hardware infrastructure,” Tan said, reinforcing what he described as the growing role CPUs play in the AI era.

Intel’s strategy rests on the belief that AI will not sideline general-purpose processors but expand their importance. As AI systems become more persistent and autonomous, shifting from human prompts to machine-driven interactions, CPUs will increasingly be needed to manage traffic, coordinate workloads and connect systems, executives argued.

That view underpins Intel’s renewed emphasis on its x86 franchise, which Tan called the most widely deployed compute architecture in the world. Rather than diminishing its relevance, he said, AI is amplifying it across data centers, networks and edge devices.

Yet Intel’s confidence in its architectural position is not matched by operational flexibility. Executives described difficult trade-offs, including diverting limited internal wafer supply toward higher-margin data center products at the expense of lower-end PCs.

“We’re absolutely constrained,” Zinsner said. “To the extent we have excess, we’re pushing all of that into the data center space.”

Perhaps the most scrutinized element of Intel’s long-term plan is its effort to build a large U.S.-based contract manufacturing business. Tan was careful to temper expectations.

“Building a foundry business will take time and considerable effort and resources,” he said, adding that Intel remains early in the process.

Intel has begun shipping its first products made on Intel 18A, the most advanced semiconductor process currently manufactured in the United States, and is developing its next-generation 14A process. However, Tan made clear that capacity expansion for 14A will only proceed once customers formally commit to volume.

“My discipline is until they have a commitment to the volume, then I start to really build,” he said, signaling a departure from Intel’s earlier tendency to invest ahead of demand.

Executives said customer decisions on 14A are likely to begin in the second half of this year and extend into early 2027, with meaningful production volumes expected in 2028. That timeline broadly aligns Intel with leading global foundries.

Advanced packaging may offer an earlier sign of traction. Zinsner said customer interest has exceeded expectations, with some engagements potentially exceeding $1 billion in value.

Throughout the call, Tan repeatedly returned to execution and culture. Intel has reduced operating expenses, simplified its organization and brought in external leadership over the past year. Still, Tan emphasized that restoring consistent reliability remains the harder task.

“Accelerating yield improvement will be an important lever in 2026,” he said. “We are on a multiyear journey. It will take time to resolve.”

For investors, the message was deliberately measured. Intel is again part of the AI conversation, but it is not yet in full control of its destiny.

“The opportunity ahead is meaningful and significant,” Tan said. “But I’m also mindful of the challenges ahead of us and transparent about the areas we are doing well and areas we need to improve.”