SoftBank’s Son places $2 billion bet on Intel’s turnaround

The move underscores Son’s ambition to dominate every layer of the AI ecosystem, from design to infrastructure.

A significant vote of confidence in Intel: Japan’s SoftBank has agreed to purchase $2 billion worth of Intel shares in a deal aimed at strengthening the U.S. chipmaker’s operations and expanding the Japanese conglomerate’s AI portfolio.

“This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” SoftBank founder and CEO Masayoshi Son said in a press release issued Monday night.

According to the agreement, SoftBank will acquire 87 million Intel shares at $23 apiece, slightly below Intel’s closing price of $23.66 the previous day. The purchase represents a 2% stake in Intel and will make SoftBank its sixth-largest shareholder.

The deal was announced just hours after Bloomberg reported that the Trump administration is in talks to buy a 10% stake in Intel. It remains unclear whether SoftBank’s move will affect those discussions.

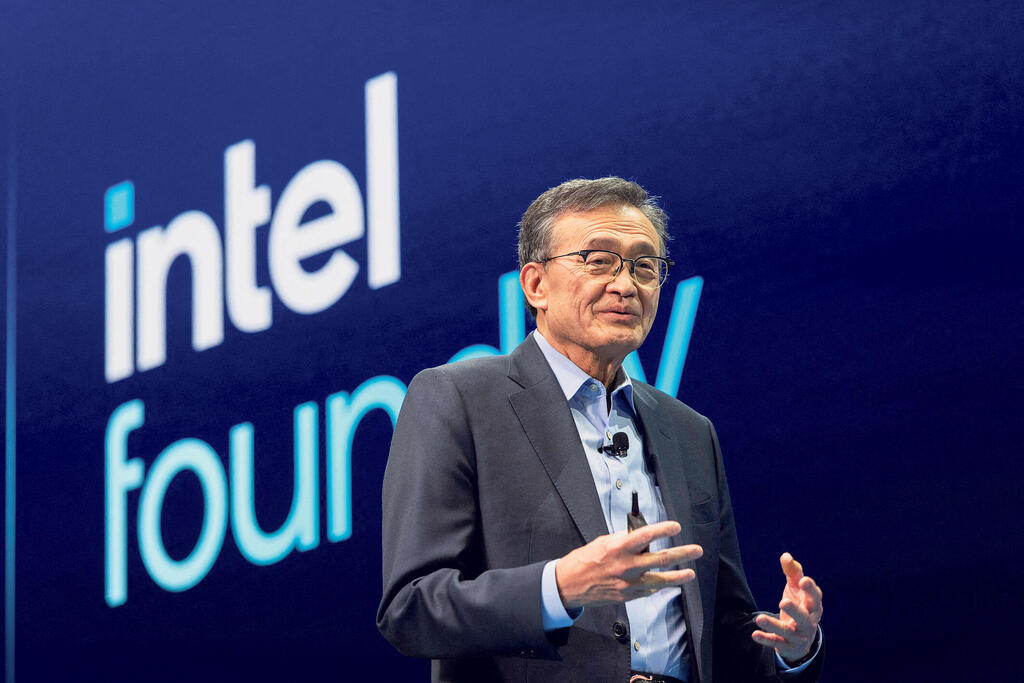

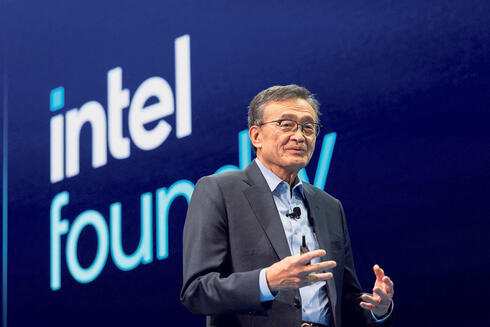

“We are very pleased to deepen our relationship with SoftBank, a company that’s at the forefront of so many areas of emerging technology and innovation and shares our commitment to advancing U.S. technology and manufacturing leadership,” Intel CEO Lip-Bu Tan said. “Masa and I have worked closely together for decades, and I appreciate the confidence he has placed in Intel with this investment.”

SoftBank’s investment in Intel is part of a broader strategy to strengthen its presence in the global chip industry, particularly in AI. Earlier this month, the company tripled its stake in Nvidia, from $1 billion at the end of 2024 to $3 billion. It also purchased $330 million worth of shares in TSMC and $170 million in Oracle. These holdings complement SoftBank’s control of Arm Holdings, the processor design company central to Son’s AI ambitions.

The Intel deal also extends SoftBank’s involvement in large-scale AI infrastructure projects. These include its partnership with OpenAI and Oracle in the $500 billion Stargate initiative to build AI infrastructure in the U.S. over the next four years, as well as ongoing talks with TSMC and others about establishing a $1 trillion AI manufacturing hub in Arizona. In addition, SoftBank completed a $30 billion investment in OpenAI in March, valuing the company at $300 billion, and acquired chip design firm Ampere Computing for $6.5 billion.

Son has made clear that his ambition is to position SoftBank across the entire AI value chain, from chip design and production to the end-user products and services powered by those chips. As he told shareholders in June: “We are pursuing AI through an array of startups and groups of companies. We have one goal. We will be the number one platform for artificial intelligence.”

For Intel, the deal represents more than just a financial vote of confidence from one of technology’s most influential figures. The company has been struggling with a prolonged crisis, having missed both the mobile revolution and the first wave of AI computing. The costly plan of former CEO Pat Gelsinger to transform Intel into a leading foundry, competing with TSMC to produce advanced chips for companies like Nvidia, has yet to deliver results, despite tens of billions of dollars in investment. Revenues and profits continue to decline, forcing Intel into multiple rounds of layoffs, the latest of which took place this summer.

Lip-Bu Tan, who took over as CEO in April, is seeking to leverage his experience in venture capital and semiconductors to engineer a turnaround. The SoftBank deal marks his most prominent step so far, built in part on his longstanding relationship with Son. Tan previously served as an independent director at SoftBank between 2020 and 2022.

Beyond the show of confidence in Tan and Intel’s strategy, SoftBank’s entry also opens the door to potential synergies with Son’s broader portfolio. These could include promoting Nvidia as a foundry customer for Intel, sharing expertise with TSMC, and gaining early access to Arm’s latest architectures.