10:27

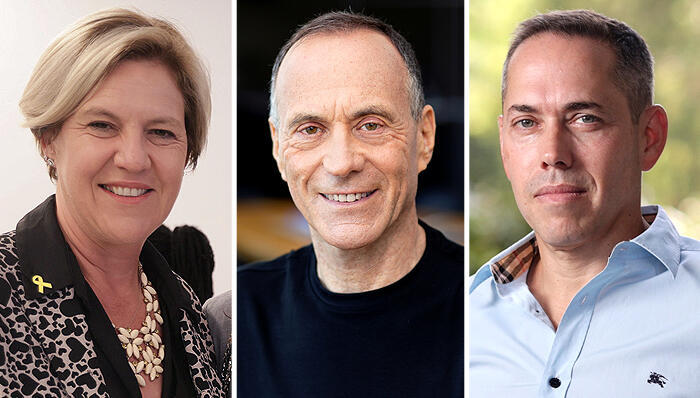

“Israeli tech post-October 7th could not be in a better position”

10:26

“It may feel uneasy, but letting software act independently isn’t optional, it’s necessary for survival today”

10:24

“One of the most undervalued opportunities is next-gen HR and talent intelligence”

10:16

SaaS rout deepens as AI fears hammer Wix and monday.com