ChatGPT is about to show ads, and the future of OpenAI hangs in the balance

A last-resort move could either secure the company’s dominance or hand an advantage to rivals.

It is a jaw-dropping statistic: in a single year, OpenAI’s revenue more than tripled and is now comparable to the annual revenues of companies such as Adobe, Micron, General Mills, and Colgate-Palmolive. But that revenue comes with a large asterisk. As OpenAI grows, so do its expenses, and no matter how much money it makes from paid subscriptions, it needs far more.

That is why, over the weekend, the company took a step that could fundamentally reshape its finances, and perhaps the entire AI assistant market: integrating advertising into ChatGPT. Whether this move stabilizes OpenAI or opens the door for competitors such as Google to overtake it remains an open question.

On paper, 2025 was a remarkable year for OpenAI. According to data released by the company on Sunday, annual revenue reached $20 billion, representing growth of 233.3% compared with 2024. “This is growth on a scale we’ve never seen before,” said chief financial officer Sarah Friar. The pace accelerated from the previous year, when revenue rose 200%, from $2 billion in 2023 to $6 billion in 2024.

Yet the figures carry a clear warning sign: revenue growth appears tightly coupled with expense growth. OpenAI has not published data on its costs or losses, but the scale of its spending can be inferred from its computing footprint. In 2025, the company reported having 1.9 gigawatts of computing power at its disposal, roughly equivalent to the electricity consumption of two million households, or about 12% of Israel’s peak electricity output, an increase of 216.7% from 2024.

Such an expansion implies costs running into the hundreds of billions of dollars, sums that even $20 billion in annual revenue would not come close to covering. In December, The Wall Street Journal reported that OpenAI was seeking to raise $100 billion at a valuation of $830 billion, primarily to expand its computing infrastructure. Only later did it emerge that SoftBank had completed a $40 billion investment in the company by year’s end.

It is therefore unsurprising that OpenAI declined to disclose operating profit, losses, or detailed expense figures. Those numbers would likely tell a far less optimistic story, one in which revenue growth remains inseparable from surging costs, and in which the company has yet to demonstrate a business model capable of justifying its extraordinary spending on computing power. That tension is evident in Friar’s own words: “We believe that more computing power would lead to broader customer adoption and greater capitalization.”

There is little wisdom in growing revenue by increasing expenses at roughly the same pace. The real challenge is to grow revenue far faster than costs, or even with minimal cost growth. That is a model OpenAI has not yet cracked, and until it does, it will remain dependent on repeated injections of external capital to maintain its position.

The pressure is heightened by the company’s commitment, announced late last year, to finance $1.4 trillion in AI infrastructure over eight years.

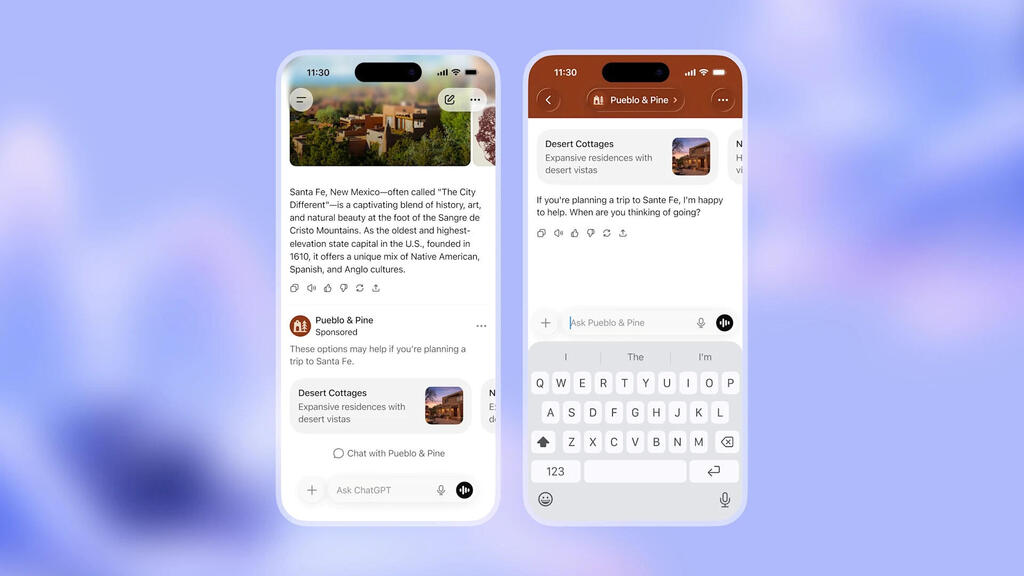

Against this backdrop, OpenAI has now unveiled what it hopes will be a solution: advertising inside ChatGPT. The idea has circulated for years, but this weekend it moved from rumor to reality.

The company says advertisements will initially be rolled out as an experiment for some users in the United States. In the coming weeks, they will appear for users on the free tier and subscribers to the Go plan, a discounted $8-per-month offering that launched in India and is now expanding to the U.S.

“We believe in a diverse revenue model where ads can play a role in providing access to intelligence for everyone,” said Fidji Simo, OpenAI’s CEO of Applications. She emphasized that advertisements would not affect ChatGPT’s answers, that conversation content would not be shared with advertisers, and that ads would not be served to minors on sensitive topics such as mental health. “With the launch of ads,” she said, “it’s essential that we preserve what made ChatGPT so great. That means trusting that ChatGPT’s answers are objective and not driven by advertising.”

As recently as October 2024, founder and CEO Sam Altman described advertising as a “last resort.” “I hate ads,” he said at the time. “Ads plus artificial intelligence is something that is particularly unsettling to me. When ChatGPT writes me an answer, I don’t think I would like having to figure out who is paying for which part of it.”

But in artificial intelligence, a year and a quarter is an eternity. That last resort has now arrived. The appetite of large language models for computing power is seemingly endless, and OpenAI is racing against giants such as Google, Amazon, and Meta to build the infrastructure required to train and operate the next generation of AI systems. Without dramatically higher cash flow, it risks falling behind.

There is already a growing consensus that Google’s Gemini currently leads the market, intensifying the pressure on OpenAI to regain its edge.

The irony is that the very step OpenAI is taking to survive could undermine it. Advertising, almost by definition, degrades the user experience. Companies can tolerate this when users lack credible alternatives, but that is no longer the case. The market is crowded with AI assistants that rival, and in some cases surpass, ChatGPT.

Some competitors, notably Google, benefit from balance sheets that allow them to operate AI products at a loss for years. Google can afford to run Gemini without ads, subsidized by its vast existing revenue streams, even offering free premium access to large populations, such as students worldwide.

Advertising may provide OpenAI with a new revenue stream, but it also risks damaging the ChatGPT experience in ways that could push users toward competitors that do not need ads to survive. With no strong lock-in mechanism, such as a proprietary social network or user-generated content, users would face little friction in leaving if advertising were perceived to compromise the product, even symbolically.

That is now OpenAI’s central challenge: integrating advertising in a way that produces meaningful revenue without driving users away. If it succeeds, its path toward becoming the next great technology company may be assured. If it fails, OpenAI could become one of Silicon Valley’s most dramatic rise-and-fall stories.