Top 50 Startups List

The 50 most promising Israeli startups - 2024

Economic slowdown, judicial overhaul, fleeing investors, October 7, and a war. By any measure, the past year was the most difficult in the history of local high-tech, making this year's 50 most promising startups the epitome of excellence.

It could be said that New York’s unofficial motto is ‘If you can make it here, you can make it anywhere.’ Well, for the Israeli startup ecosystem, the motto could be ‘If you succeeded in 2023, you'll succeed in any situation.’ The past 12 months since Israel's 75th Independence Day and the release of last year’s edition of the "50 Most Promising Startups" have been the toughest in the history of the local tech industry. The global economic slowdown and the shrinking investments were followed by the government’s attempted judicial overhaul, which caused foreign investors to keep their distance, before the last quarter of the year was overshadowed by the events of October 7 and subsequent war in Gaza. Even the veterans of the dot-com bubble in the early 2000s which coincided with the Second Intifada and 9/11 didn’t experience the challenges faced by today's startup entrepreneurs.

Startup employees tend to be very young, and between 15-20% of employees at an average Israeli startup were called up for reserve duty after the outbreak of the war. The younger the company and the smaller its team, the higher the percentage of reservists, especially for companies where the founding members came from the same military unit, which is typical. Sometimes, even the founders and CEOs were called up for long periods and found themselves working from laptops in Gaza. The skies closed with the suspension of many international flights, so meetings with clients and investors abroad became a challenge, the latter of whom were in no rush to come to Israel and preferred to wait for quieter days. And this is all in addition to the grim national mood and tremendous emotional upheaval for the average Israeli, most of whom knew someone killed on October 7 or during the war.

Israeli startups are in competition with companies from countries that aren’t at war, who haven’t experienced being targeted by swarms of Iranian missiles and drones; who can fly freely to wherever they please and not be treated as pariahs or encounter protesters objecting to their very existence. For all of these reasons, in May 2024, Israeli startups need to be better than the best. And the startups on the list this year are exactly that. They are developing innovative solutions, selling them to customers worldwide, and also raising money from investors, sometimes with missile sirens wailing in the background.

Even putting our local troubles to the side, the global tech ecosystem has not yet fully returned to what it once was, and there were very few IPOs and new unicorns born in the past year. Many of the companies highlighted in last year’s list, and even the ones before that, have made significant progress, but for many others, the anticipated exit has not yet come.

This year, we have limited the age of the startups. Startups aged 10 and older who have yet to fulfill their goals may never do so. Therefore, this list almost exclusively includes companies that are under seven years old. We could have made things much easier for ourselves and built a list entirely composed of cyber companies, considering Israel's enormous relative advantage, and whose reputation in this area remains surprisingly unaffected by the security and technological failures of October 7. But Israel’s startup ecosystem extends far beyond cyber, and, in fact, the biggest Israeli exits mostly came from chip and hardware companies. Cyber should not be underestimated, especially not Israel’s unique capabilities, but we also want to foster companies in foodtech, cleantech, and AI, the latter of which was, from the investment world's perspective, the big revolution of 2023.

And since we are in Israel, where war is our reality, we also included companies developing technologies that assist in military efforts, from drones to tunnel detection. We also could have easily focused our list on this subject alone, but we don't want to only look at war, but look forward to a quieter and more optimistic future for Israel and its citizens.

1. Faye

Sector: Insurtech | Established: 2019 | Founders: Elad Schaffer and Daniel Green | Employees: 60, in Israel and the United States | Funding: $20 million from Viola, F2, and Munich Re

"For Americans, Faye has become part of their passport"

For the average Israeli, purchasing travel insurance abroad is a given. Just as the rate of supplementary insurance in Israeli HMOs is one of the highest in the world, so too is the rate of Israelis who purchase travel insurance abroad. For Americans, however, it's a completely different story. Most Americans only realized the need for travel insurance following the COVID-19 pandemic and its consequences, which has been one of the strongest forces driving the growth and success of Israeli insurtech company Faye.

While Israelis mainly purchase travel insurance in case something happens when they’re abroad, Americans, many of whom have only recently disovered travel insurance, primarily purchase it as protection against flight cancellations or delays. Many Americans have learned the hard way the chance of getting a ticket refunded when one has to cancel due to illness. Additionally, flight cancellations are a common issue for American airlines, which Israelis have only become familiar with in the past year since many flights to Israel were canceled. American statistics show that 1% of flights are canceled every day, unrelated to extreme weather. During storms and other weather incidents, the rate of canceled flights on a daily basis jumps to 10%.

Meanwhile, the American travel insurance market has been growing in recent years. While the majority of Israelis always travel with travel insurance, less than 40% of American travelers do. However, 68% now say they are interested in such insurance. According to Elad Schaffer, Co-Founder and CEO of travel insurance company Faye, the market penetration rates are extremely low at only about 10%. Despite this, the American travel insurance market already generates $6 billion, indicating a vast untapped potential.

2. Trullion

Sector: Enterprise Software | Established: 2019 | Founders: Isaac Heller and Amir Boldo | Employees: 85, in Israel and the United States | Funding: $35 million from Aleph, Third Point Ventures, Greycroft, StepStone Group

How Trullion is transforming the accounting industry one innovation at a time

Startup company Trullion, which operates in the seemingly boring field of automation solutions for the world of accounting, has become one of the hottest things in the Israeli high-tech scene. Its founder Isaac Heller went from being a strange bird to one of the most sought-after entrepreneurs in Israel. He hasn't even touched the $15 million he raised last year, but the local brass is already buzzing with rumors of another large fundraising that will be completed very soon. This is how it is when investors want to jump on the successful bandwagon that is racing not only in terms of promises but also in terms of income.

Trullion already enjoys an annual revenue rate of more than $10 million and in the contracts already signed it has the potential for much higher numbers. Leading international accounting firms such as EY and Deloitte recommend Trulion's product to their clients and a few months ago it signed an agreement with one of the largest companies in the world, whose name cannot be disclosed at this stage.

The story of Trullion actually begins in Texas, where Heller was also born. The Texan energy giant Enron, which was based in Houston and employed about 30,000 workers, collapsed in 2001 after it became clear that its reports had been distorted for years. The company lost more and more money, while its executives had golden toilets. The scandal led, among other things, to the liquidation of Arthur Andersen, one of the largest accounting firms in the world (and also one of the largest in Israel) which was responsible for the Enron reports - and for a profound change in the American regulation concerning financial reporting and corporate responsibility. The Sarbanes-Oxley Act that was enacted in its wake changed the rules of the game and led to a paucity of IPOs on Wall Street in the first decade of the century because the companies had difficulty coping with the new and stricter reporting requirements.

3. Exodigo

Sector: Underground mapping using AI | Established: 2021 | Founders: Jeremy Suard and Ido Gonen | Employees: 216 in Israel, the U.S., and the UK | Funding: $118 million from Greenfield Partners, Zeev Ventures, Square Peg, 10D, JIBE, National Grid Partners, Waxman Govrin Geva, Tidhar, and Israel-Canada

Rising from the depths: Exodigo’s journey through war and innovation

On October 7, Jeremy Suard, Co-Founder and CEO of Exodigo, found himself quickly packing clothes and heading towards Gaza. He wasn’t alone; 60 out of Exodigo’s 80 employees were also drafted into reserves, some to selected combat units and others to various intelligence units. One employee, Amit Shahar, was killed while serving as a reservist in a combat engineering unit in January. Employees who were drafted remained in the reserves for as long as three months. Simultaneously, employees at the Israeli office and those working overseas, worked intensively and managed to sign quite a few deals, but asked most clients to hold off on implementing them immediately. The war not only did not stop the company but also taught its management and other employees to cope with extreme circumstances, not long after the company’s founding in 2021.

Exodigo, which has already raised over $100 million, was founded by alumni of the IDF’s intelligence units. They veered from tradition by opting not to establish yet another cyber company, as most army intelligence graduates do, but to develop an AI solution for underground mapping, produced through simulation of multiple sensors, 3D imaging, data fusion, and a proprietary AI platform. Its technology allows for subterranean infrastructures and various subsoil features to be identified on a map without the need for time-consuming and costly digging operations.

The company is currently transitioning from combining full-service scanning through its scanning system to having its scanning system operate independently, allowing Exodigo to be a technology-only company. In the coming year, which is expected to be a major breakthrough year for the company, Exodigo is planning to double its number of employees. At the end of 2024, the company will employ about 220-230 employees worldwide. In 2023, the company signed contracts worth about $10 million, and according to estimates, it will sign additional contracts worth tens of millions of dollars this year.

4. Chain Reaction

Sector: Chips | Established: 2019 | Founders: Alon Webman and Oren Yokev | Employees: 100, 90% in Israel and the rest in the USA | Funding: $115 million from JVP, Hanaco, Morgan Creek Digital, KCK Capital, Exor, Atreides Management and BlueRun Ventures

The Mellanox of crypto

"Mellanox has already happened and as an entrepreneur you always want the next thing you build to be bigger," said Alon Webman, one of the two founders of Chain Reaction, whose resume already has one huge success - founding Mellanox alongside Eyal Waldman. Webman, who was one of the top executives at Mellanox, left the company just before its sale to Nvidia for $7 billion and is now aiming even higher.

Chain Reaction is today in a position that could in retrospect be "just before its big breakthrough" that will put it firmly on the global chip map. But this is also a crossroads that presents plenty of risks. Since the founding of the company in 2019 by Webman, together with his friend from their Technion days Oren Yokev, who was a senior member of the Shin Bet (The Israel Security Agency), the Israeli startup has been developing a chip for mining cryptocurrencies. This chip is supposed to challenge the Chinese company Bitmain, which currently dominates this market. The market grows at a rate that reaches 60% a year, depending on the fluctuations in the price of Bitcoin, and is estimated at $15-20 billion.

After quite a few delays, it is estimated that in the third quarter of this year, Chain Reaction will begin supplying its chips, which operate the mining systems, to customers with whom it has signed agreements over the past few years. It manufactures the chips in TSMC factories. If the company's chips do present real competition to Bitmain, in terms of performance and pricing - a very important element for this industry, especially during periods of falling prices - it could quickly become a significant player in the field with high revenues. In case the company doesn’t grow at the planned speed in the crypto market, Chain Reaction is also targeting the cloud space, where the company has developed a solution to ensure privacy when using data centers. The company believes that in light of the explosion of the GenAI industry, what started as a relatively small and sideline activity of chips that enable the processing of encrypted information may actually become the larger field in a few years.

5. Pinecone

Sector: AI | Established: 2019 | Founder: Edo Liberty | Employees: 150 in Israel, Europe, and the USA | Funding: $140 million from Andreessen Horowitz, ICONIQ Growth, Menlo Ventures, and Wing Ventures Capital

Unlocking the future of AI with vector database

Timing is often crucial to the success of a tech company, and this is true for Pinecone, founded by Edo Liberty, a former Senior Research Director at Yahoo and later Head of Amazon AI Labs at AWS. He spearheaded the development of SageMaker, Amazon's AI infrastructure. In 2019, Liberty realized that a huge AI revolution was coming. To that end, he founded Pinecone, raising an initial $10 million for the company's product development - a smart search database based on vectors that can provide results not only based on keywords but also on context.

The company developed a vector database that enables engineers to work with data generated and consumed by Large Language Models (LLMs) and other AI models. Pinecone's technology is today for most companies the only way to implement AI systems with organizational knowledge. It combines the capabilities of LLMs with the search capabilities of the company, enabling the use of knowledge within organizations. The technology has become a vital infrastructure for building fast and accurate AI applications on a large scale.

Pinecone doesn’t compete with cloud giants like AWS or Microsoft but is now a competitor and partner to all major LLM creators, such as OpenAI and others. The company has a significant R&D center in Tel Aviv with dozens of employees, many of whom have PhDs in related areas, where the core technology of the company is developed. They also have significant offices in New York and San Francisco and are expanding into Europe.

As early as 2022, Pinecone recorded initial revenues of several millions, jumping to tens of millions in 2023 with expectations for significant growth in 2024 as well. The company’s change in revenue resembles a larger global trend. In its early stage, the main target of Pinecone’s technology were startups and others who used it to develop technological tools much faster. Then, following the growing demand for AI-based systems from many organizations, Pinecone reached corporations and large companies. These are already infusing the company with many long-term multi-million dollar contracts. This gives the company not only rapid revenue growth but also a reliable revenue stream for the future.

In order to meet high demand and dominate the market, the company raised $100 million led by Andreessen Horowitz, considered one of the leading funds in Silicon Valley.

6. FundGuard

Sector: AI-based cloud | Established: 2018 | Founders: Lior Yogev, Yaniv Zecharya, and Uri Katz | Employees: 120 in Israel, Great Britain, Canada, and the USA | Funding: $150 million from Key1 Capital, Euclidean Capital, Hamilton Lane, Blumberg Capital, Team8, Citi, State Street

The founders of FundGuard have created a platform for managing mutual funds, ETFs, and insurance products, convincing financial institutions to replace their outdated systems.

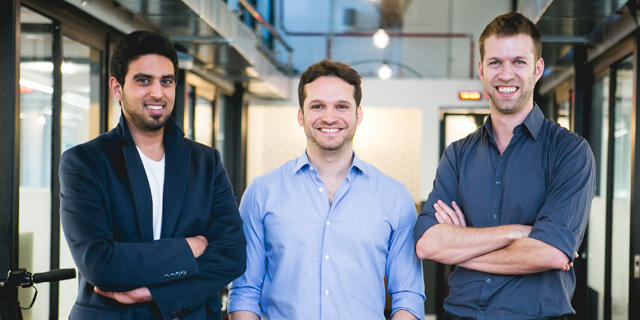

25 View gallery

FundGuard founders Lior Yogev (CEO), Yaniv Zecharya (CTO), and Uri Katz (VP R&D).

(FundGuard)

The founders of FundGuard - Lior Yogev (CEO), Yaniv Zecharya (CTO), and Uri Katz (VP R&D) - opted not to embark on the challenging path of the fintech industry and establish yet another company focusing on payments. Instead, they chose to establish an infrastructure company for the mutual fund industry. This is a challenging field to develop technology for, and it is even more challenging to sell a product to financial institutions that tend to be very conservative when it comes to their technological infrastructures.

However, the company's founders, who met during their military service in Unit 8200, realized that the world is changing and that the needs of these companies are changing as well, especially with the increase in the complexity of financial assets and regulatory requirements. They have developed technology that provides a solution for managing various financial products, such as mutual funds, ETFs, hedge funds, insurance products, and pension funds. All of this is done while implementing automation, improving work processes, and enhancing collaboration capabilities between different units and companies in case management and administration.

The systems built by FundGuard replace outdated systems installed in most banks that cannot meet these challenges. The company's technology enables the identification of problems and failures, providing practical insights to improve management while facilitating operational efficiency and dramatically reducing financial institutions' expenses.

FundGuard's platform is currently used by some of the largest financial entities in the world in the field of investment portfolio management, managing assets worth many trillions of dollars. The company took a significant leap forward with the raising of $100 million this year, which is not a trivial amount at any time, but especially so in the heart of a global financial crisis. The funds, all of which flowed into the company's coffers without secondary investment, will allow it to significantly expand its workforce, both for salespeople and for the development team in Israel. However, the main reason for the funding round is a series of significant contracts with leading financial entities, some of which have even invested in the company.

A large portion of these contracts will bring FundGuard revenues of up to $100 million per contract over several years. The company is estimated to bring in about $20 million this year alone and expects to more than double its revenue by 2025. Today, the company is not only interested in licensing its technology to financial institutions but also in the possibility of being acquired. However, FundGuard has so far rejected any acquisition offer, mainly because its managers feel that it is still far from realizing its full potential.

7. NoTraffic

Sector: Transportation | Established: 2017 | Founders: Tal Kreisler, Uriel Katz, and Or Sela | Employees: 110 (70 in Israel, remainder in the USA) | Funding: $75 million from Grove Ventures, VNV Global, UMC Capital, Vektor Partners, Next Gear Ventures, North First Ventures, Meitav Investment House, and TMG

Traveling in big cities is notorious for being a nightmare, regardless of location. Despite the prevalence of traffic jams, accidents at crosswalks, and high air pollution caused by the number of vehicles on the roads, no technology has yet been developed to tackle the problem comprehensively. Many companies focus on improving public transportation, but few address the movement of all vehicles, including private ones. In 2017, the Israeli company NoTraffic embarked on a journey to transform traffic light systems in cities from static to dynamic, operating in real time.

The platform they developed turns sets of traffic lights into a digital network, autonomously managing traffic in urban areas according to the operator's policy. It connects all players in the transportation arena, including vehicles, traffic light systems, road users, pedestrians, and cyclists. In 2022, the company, founded by Tal Kreisler (CEO), Uriel Katz (CTO), and Or Sela (VP R&D), began selling this system alongside signing a series of distribution agreements and strategic partnerships across the United States.

Within a short period, the company secured deals in 26 U.S. states, with hundreds of transportation departments in the United States alone. Its clients include some of the largest states in the U.S., such as California, Texas, and Pennsylvania, with partnerships established with major technology and infrastructure companies worldwide, including AT&T, Qualcomm, Rogers Communications, and NVIDIA. To date, the company has raised approximately $75 million, with the last fundraising round of $50 million almost a year ago, intended for further growth.

The smart traffic systems market in which the company operates is growing significantly and is expected to reach approximately $84.8 billion by 2027. This growth is fueled by government initiatives to implement advanced traffic management systems, such as the infrastructure law in the United States, which emphasizes upgrading and repairing the country's infrastructure system with a $1.2 trillion investment. Additionally, there is a growing demand for technological measures to reduce casualties in road accidents, pollutant emissions, and traffic congestion.

The platform's effectiveness has been demonstrated in cities like Tucson, Arizona, where prolonged traffic jams were resolved following system installation. In Phoenix, Arizona, the system led to a 70% decrease in vehicles running red lights, while in British Columbia, Canada, pedestrians' waiting time for traffic lights was halved without impacting traffic flow.

8. Robust Intelligence

Sector: AI | Established: 2019 | Founders: Yaron Singer, Kojin Oshiba | Employees: 65 in the U.S., Japan, and Israel | Funding: $34 million from Tiger Global and Sequoia

Like quite a few startup companies in general and on this list, Generative AI changed everything for Robust intelligence. Fortunately for the young company established, it was for the better. The Israeli Yaron Singer, who was one of the youngest mathematics professors at Harvard University (at the age of 40 he already held tenure), developed a kind of firewall that protects artificial intelligence from mistakes. Robust's solution was a little ahead of its time, because until the introduction of ChatGPT and Google's Bard, which sometimes made embarrassing mistakes, not everyone was aware of how disastrous such mistakes could be, especially when it comes to business applications for sectors such as the finance industry.

In the last year and a half, it has become much easier for Singer to explain to potential customers the consequences of the hallucinations of artificial intelligence engines, however advanced and sophisticated they may be, and Robust is enjoying a surge in demand for its systems. The fear of errors in these engines also led Microsoft to develop protection tools that compete with those of Robust and other companies. The point is that this is a field with a very high technological barrier. The development of the firewall by Singer and his partner took many years and began in academia. The company tripled its revenues for the second straight year in 2023. Those around Singer testify that he receives five emails a day from various investment funds that want to invest in the company, and therefore it is reasonable to assume that by the end of the year Robust will not hold back and will go on a big funding drive. Robust is also planning to expand its presence in Israel and establish a local development center, after employing only a small part of its team in the country to date.

9. Darrow

Sector: Legal Tech | Established: 2020 | Founders: Evyatar Ben Artzi, Gila Hayat, Elad Spiegelman | Employees: 110 | Funding: $59 million from Georgian, F2, Entrée Capital, and NFX

One field where technological disruption hasn't fully penetrated is the legal sector. Despite computerization, advanced AI and cloud systems are still lacking. Israeli company Darrow, founded by Evyatar Ben Artzi, a lawyer who interned in the Supreme Court, and Gila Hayat, a graduate of Unit 8200, has pioneered a legal intelligence platform used by numerous law firms.

Their platform scans various web sources to identify potential law violations, analyzing publicly available data such as network traffic and social media communications. By comparing this data to case law and legislation, anomalies indicating potential violations are flagged. Darrow not only provides cases to law offices but also matches each claim with the appropriate office.

Currently working with dozens of law firms, Darrow generated $50 million in revenue for them in 2021. Its income mainly stems from successful claims, where it receives a percentage. With plans to expand into labor law and environmental protection, Darrow secured $35 million in funding in September 2023 from leading venture capital funds like Georgian, F2, Entrée Capital, and NFX. With the significant revenue it is already creating, Darrow hasn't even used the money it raised.

10. Bluewhite

Sector: Agrotech | Established: 2017 | Founders: Ben Alfi, Yair Shahar, and Aviram Shmueli | Employees: 150 (in Israel and the USA) | Funding: $89 million from Insight Partners, Entrée Capital, Clal Insurance, Allied Investments, Regah Ventures, Peregrine Ventures, and Jesselson

The field of advanced agriculture, or agrotech, holds immense significance for global food security, yet few companies have emerged as major players. The ongoing food security crisis, exacerbated by population growth and shrinking agricultural areas, underscores the urgent need for solutions. Various technologies aim to address the issue, from altering crop cultivation methods to optimizing farmers' work and conserving labor.

One standout company poised to revolutionize agriculture is Bluewhite (formerly Blue White Robotics). Named after the colors of the Israeli flag, BWR has developed an autonomous robotic solution for diverse agricultural tasks. Their technological solution combines hardware and software, facilitating convenient management of agricultural vehicle fleets and remote information retrieval. The company's hardware can be installed on any tractor, enabling autonomous navigation and task execution, such as sowing, spraying, cutting, and harvesting, even in challenging conditions. Their software analyzes received data, providing real-time insights and reports to ensure farm operational efficiency.

Led by founders Ben Alfi, Yair Shahar, and Aviram Shmueli, Bluewhite aims to bridge the gap between agriculture and technology, enhancing productivity and addressing labor shortages. Their systems enable a single operator to manage eight tractors simultaneously, specializing in orchards with a focus on vines, oranges, apples, and almonds.

A recent funding round of $39 million will fuel Bluewhite's vision of autonomous tractor deployment across numerous farms and states in the United States. Presently, the company serves 20 significant customers covering approximately 600,000 dunams, with 150,000 autonomous tractor hours logged. With impending agreements with leading distributors, Bluewhite anticipates significant revenue growth and sustained visibility for years to come.

11. NeuReality

Sector: DeepTech | Established: 2019 | Founders: Moshe Tanach, Tzvika Shmueli and Yossi Kasus | Employees: 70, in Israel | Funding: $70 million from the European Innovation Council, Varana Capital, Cleveland Avenue, OurCrowd, and XT Hi-Tech

The AI race is now the heart of the global high-tech industry and the business world in general. The company leading the great revolution today is Nvidia, but companies are starting to emerge alongside it and are discovering that the giant has many gaps and especially huge costs. The Israeli startup NeuReality wants to significantly reduce the costs of development in the inference phase - this is the phase where you take new information, and the model deduces for you what you want from it. The model actually creates for you the answer you asked for, unlike the training phase of the model, where today most of the activity and competition between the companies takes place. NeuReality identified the problem of inference as a bottleneck in the field as a result of the rapid growth and volume of information that needs to be processed.

NeuReality was founded in 2019 by Moshe Tanach, who currently serves as the company's CEO, Tzvika Shmueli, who serves as VP of operations, and Yossi Kasus, who serves as VP of chip development. All three previously held key positions in leading companies such as Intel, Mellanox, and others. The company is trying to replace giant companies such as Intel and significantly reduce development costs in the field and also speed up the development of models.

According to the test done by the company, the use of its chip can reduce the cost of applications such as ChatGPT and others by up to 10 times. The company has already completed the development of its first chip system and has begun initial sales to large customers including financial giants and cloud service providers. In the chip industry, each contract begins with an initial order of a few million dollars and can quickly turn into huge contracts of tens and hundreds of millions of dollars.

In March of this year, the company raised $20 million, with the European Innovation Council fund among the investors in the current round. According to estimates, in the coming year the company will embark on a more significant funding round which will allow it to enter an accelerated pace of developing and selling the chips. At a more advanced stage, the company intends to connect with cloud providers in the field of artificial intelligence and offer its solution in a subscription model. Currently, the company employs 70 people, but the company's heads aim to recruit several dozen employees immediately and end 2025 with about 150 employees.

12. XTEND

Sector: Drones | Established: 2019 | Founders: Rubi Liani, Matteo Shapira, Aviv Shapira, and Adir Tubi | Employees: About a hundred in Israel, Singapore, and the USA | Funding: $68 million from Caltech, Chartered, NFX, Lool Ventures, TPY

There are companies that were harmed by the Gaza war as a result of extensive call-ups to the reserves of their workers or the cancellation of funding rounds, and there are some that received a boost from the war. XTEND is a good example of the latter type of company. The company develops an operating system for drones and robotic tools, and enables their operators to perform complex tasks in any environment with minimal training time. In doing so, it provides a new way to use robotic tools effectively from a safe distance. Until October 7, the founders of the company thought that there was not much future in the military field and set their sights on the civilian sector. Immediately after October 7, the company was recruited for one purpose, to provide the IDF with systems that would assist it in the war.

Before the war, the company supplied about a thousand drones in eight months, but after it started it was asked to supply over a thousand a week. At the beginning of the war, the company froze fundraising and mobilized to help the IDF, which in return purchased many systems from it that made it profitable and provided it with breathing room.

The company also received purchase requests from foreign countries that had not previously done business with it. When the IDF's needs settled, the company returned to focus on the business activity and was freed to complete its funding round.

XTEND raised $50 million in a Series B led by the Chartered Group, with the participation of existing and new strategic investors, including Claltech. With the money it raised and the skills it developed, the company intends to turn to the military market which will be an important part of its activity and to invest significantly in expanding its team in the United States in order to increase sales, as well as to continue developing the system while continuing to integrate artificial intelligence capabilities.

13. D-ID

Sector: Artificial Intelligence | Established: 2017 | Founders: Gil Perry, Sella Blondheim, and Eliran Kuta | Employees: 90 in Israel and the U.S. | Funding: $48 million from Pitango, OurCrowd, Macquarie, Maverick, AXA Ventures, Y Combinator

Like many startups, D-ID was also born from the military past of its founders, but not in the conventional way. Gil Perry and Sella Blondheim, both of whom are 37 years old, served together in the General Staff Reconnaissance Unit, more commonly known as Sayeret Matkal, and after their service went on a big post-army trip together. There they both encountered a problem - they wanted to share photos from their shared experiences on social networks like their friends, but for the two, who have now spent long months serving in the reserves in Gaza, it was forbidden to be seen on social networks. This is how the idea was born to develop a technology that was the opposite of what most companies wanted to do until then - one that would actually prevent facial recognition. Perry and Blondheim decided to try it out, working at several such companies first, and met Eliran Kuta, the third founder, who came armed with experience from the worlds of programming and cyber after serving in Unit 8200. The way to protect against facial recognition is to create what is known today as a Digital Human, a kind of digital duplicate of a human being that can look exactly like one, but the computer algorithms will not recognize it due to a change in some important characteristics.

This was the initial direction of D-ID, but with the breakthrough in technologies related to the world of generative AI, the founders realized that they needed to shift their focus. Indeed, the company has grown tenfold since adapting its solution to the new world. Among its clients are a third of the Fortune 100 companies and thousands of other small and medium-sized businesses. D-ID's main business today is "the humanization of bots", so that we feel more comfortable talking to them. The human digital market is huge and is estimated at half a trillion dollars. The company focuses on the niche of marketing and sales, and sells companies a solution that produces characters that look and sound completely human. D-ID is of course aware of the ethical problems that its technology may produce and for that purpose, they recruited an advisory committee made up of experts in the field.

14. Greeneye

Sector: Agrotech | Established: 2017 | Founders: Nadav Bocher, Dr. Itzhak Khait and Alon Klein-Orback | Employees: 50 in Israel and the USA | Funding: $45 million from Deep Insight, JVP, Syngenta Group Ventures, Orbia Ventures, FBN, and Eyal Waldman

Agriculture is a field that needs technology and cost-cutting measures. Every farmer knows that many resources are wasted in the field unnecessarily: too much water in irrigation, too much fertilizer for plants, and every year, farmers around the world use millions of gallons of herbicides - the vast majority of which are sprayed wastefully and ineffectively, on bare soil or the crop. The increased use of chemicals causes damage to the environment, and the weeds develop resistance to herbicides, so the economic burden on farmers increases significantly.

Israeli agtech company Greeneye, founded by entrepreneurs who served together in the elite Air Force unit Shaldag, has developed a system that combines hardware and software that saves those farmers a lot of resources. The system allows farmers to go from uniform spraying of pesticides over the entire field to surgical and precise spraying only on the weeds in it. Greeneye's system interfaces with any existing sprayer, regardless of its model, and turns it into a smart machine. According to the company's assessment, the system it developed has proven to reduce herbicide use in farming by 88%.

The system includes 24 cameras and 12 sensors that are attached to the sprayer, and locate only the plants that need spraying. Each system is sold for about a quarter of a million dollars, and the farmer returns the investment in about 18 months. Today, the company focuses on detecting pests and spraying weeds, but it intends to expand into areas of spraying additional crops. With this expansion, the company is expected to have an additional source of income, where any addition will be part of the farmer’s subscription. The company currently operates in eight states in the Midwest of the United States and focuses on corn, soy, and cotton crops.

Greeneye believes that its future is not only in the United States, and following a fundraising of approximately $20 million this year, it is working to expand to South America, Canada, and Europe. The capabilities it has developed, which combine computer vision and artificial intelligence, give it the opportunity to develop more solutions to the multitude of crops and waste of resources in agricultural fields. The company's revenues are in the millions of dollars, and it has set a target for rapid growth in the coming year.

15. MineOS

Sector: Privacy | Established: 2019 | Founders: Gal Ringel, Gal Golan, and Kobi Nissan | Employees: 39 in Israel and the USA | Funding: $42.5 million from Battery Ventures, PayPal, Nationwide, Gradient Ventures, Headline Ventures, MassMutual Ventures, Saban Ventures

One of the tasks that worries companies in the technological age is dealing with the issue of online privacy and the extensive regulation related to it. The regulations vary between continents and countries, forcing companies to invest considerable resources in managing the field to avoid lawsuits and harm to privacy. The Israeli company MineOS, founded in early 2019 by Gal Ringel, Gal Golan, and Kobi Nissan, is trying to help those companies. It developed software that scans all the data held by a company, compares it to the laws of the country in which it operates, alerts in the event of a violation of a law or regulation, and suggests a way to correct the situation.

When it started, MineOS addressed private individuals to help every citizen get organized information about their private information exposed on the net. Later, the entrepreneurs realized that engaging in the civilian side may well create an opportunity for exposure, but the revenue will come mainly from enterprises that need tools to help them avoid violating privacy laws and harming citizens.

In the last year, shortly after the outbreak of the war in Gaza, the company managed to complete a significant funding round of $30 million. Among its investors are very impressive names such as PayPal, Google's AI fund, and Haim Saban's investment fund, which will enable it to realize its vision. In recent months, the company has added significant team members, which include a CFO and a very senior VP of sales. Unlike many companies that value growth over profitability, MineOS calculates expenses very carefully. The company had only around 25 employees in its last funding round. After that, it recruited 15 more employees and is expected to hire more, stressing that it will do so carefully to avoid incurring high costs.

16. Oasis Security

Sector: Cyber | Established: 2022 | Founders: Danny Brickman and Amit Zimerman | Employees: 50 in Israel and the United States | Funding: $75 million from Sequoia Capital, Cyberstarts, Accel, and Maple Capital

Although established at the end of 2022, the story of Oasis Security echoes the optimism of 2021's golden days. Investors, confident in its success, have continuously poured money into the company. Just a year and a half after its inception, Oasis has already undergone three rounds of flash fundraising, attracting investments from some of the most respected funds worldwide. Investors want to ensure that Danny Brickman and Amit Zimerman, both recently turned 30, have the resources to realize their vision in the identity management sector.

Following their departure from the technology unit of the intelligence corps, Brickman and Zimerman aimed to establish a cybersecurity startup, albeit unsure of which niche to pursue. While eyeing the identity management market, they found it seemingly saturated. A chance mention in a presentation slide, highlighting non-human identity management, sparked a revelation, propelling Oasis to pioneer this new subcategory.

Non-human identities encompass all passwords, keys, licenses, and tokens within an organization, surpassing human identities in quantity. The initial challenge lies in mapping these identities, often overlooked by cybersecurity managers, leaving systems vulnerable. For instance, departing employees often leave behind unused passwords and keys, posing security risks.

In today's saturated cyber market, finding untapped opportunities is rare, yet Oasis has seemingly accomplished just that. Now, the competition focuses on execution and securing partnerships with major corporations, much like in 2021.

17. Astrix Security

Sector: Cyber | Established: 2021 | Founders: Alon Jackson and Ido Gour | Employees: 60 in Israel and the USA | Funding: $40 million from CRV, Bessemer Venture Partners, F2 Venture Capital, and Venrock

The cybersecurity industry reinvents itself every day, and new sectors are constantly emerging with every new technological development, allowing seasoned and young cyber entrepreneurs alike to identify opportunities. Israeli cyber company Astrix was the first to identify the problem of non-human users in 2019. Since then, the company has made efforts to develop its technology and establish itself as the first company in the market, and ultimately to lead it alongside quite a few other companies, including other Israelis.

Astrix's security solution focuses on securing application connections, as opposed to existing solutions that focus on user connections. The platform provides organizations operating in the cloud with full transparency of all internal and third-party applications connected to organizational systems, through non-human connections like APIs and OAuth, and the level of access granted to each of them. It constantly analyzes the behavior of these connections to identify abnormalities that may indicate security breaches and vulnerabilities, identifying and automatically fixing unnecessary and exaggerated permissions, as well as abnormal and malicious behavior.

In the past year, the company's revenues have grown 2.5 times to millions of dollars, with the goal of reaching revenues of over $10 million in the near future. Astrix employs 60 people and expects to hire significantly more in the future as it expands its business. The company's main revenues today come from multi-year contracts that allow it to have confidence in its business forecasts.

18. Oshi

Sector: Food Tech | Established: 2021 | Founders: Ofek Ron, Dr. Ron Sicsic, Dr. Ariel Szklanny, Dr. Hila Elimelech | Employees: 30 including 27 in Israel and the rest in the U.S. | Funding: $14.5 million from SOMV, Pitango, TechAviv, OurCrowd, Smart Agro, Unovis

While the food tech sector has been chasing the perfect steak substitute, Oshi decided to swim against the current and develop a substitute specifically for salmon. Ofek Ron, the company's founder, only 32 years old, became a vegan at the age of 20. After delving into veganism, he left his career in event production in high-tech to join the non-profit Vegan-Friendly, known for its pink-green label which appears on many supermarket foods. While deeply immersed in the world of NGOs and activism, Ron recognized the vast market that existed for plant-based fish products, and his entrepreneurial spirit wouldn't let him rest.

In Israel, some vegetarians do eat fish, but in much of the world, both vegans and vegetarians abstain from it. Therefore, the fish substitute market is vast, with the best-selling item being plant-based salmon, generating annual sales of about $50 billion. Ron, who was neither in the tech world nor a scientist, hired a team of scientists for the daunting task of creating a plant-based alternative to baked salmon, one of the most popular dishes served in restaurants, resembling it in both taste and texture.

Mass production and cost reduction are among the two main challenges in the food tech industry, and in Oshi's case, the challenge is especially complex due to the unique structure of the fish, which resembles a mosaic. Oshi's scientists built a machine that produces fish flakes and assembles them like LEGO bricks, layer by layer, interspersed with layers of fat. This salmon is made from extracts of algae, soy, mushrooms, and other natural ingredients, with the added bonus of containing only half the fat and calories of real salmon, which is considered a relatively fatty fish. Now, three years since Oshi's founding, Ron's team has clearly succeeded in creating a substitute for a salmon filet. The product is already being used in a number of restaurants in the United States and will soon enter some store franchises. The large European supermarket chain Coop is already selling Oshi's salmon.

Those who have tasted Oshi’s salmon say that the texture already is extremely close to real salmon, but that the taste is not quite there. It definitely tastes like fish, but it's not the exact taste of salmon. Nevertheless, Oshi is currently ahead of its main competitors, two food tech companies from Austria and Canada, and soon the company will transfer its production from its headquarters in Rishon LeZion to the United States and will expand production capacity to meet demand.

Like most foodtech companies Oshi is far from being profitable, and the price of one of their 125-gram salmon filets is lower than its production cost. However, the company believes that if it succeeds in improving its production speed and efficiency, profitability can be achieved in the near future. In order to do so, Oshi will require significant investment in development and, therefore, must raise additional funds very soon.

19. Backslash

Sector: Cybersecurity | Established: 2022 | Founders: Shahar Man and Yossi Pik | Employees: 21 mostly in Israel | Funding: $8 million from StageOne Ventures, First Rays, D.E Shaw, Shlomo Kramer, Yevgeny Dibrov, and Nadir Izrael

Though one of the youngest companies on the list, the founders of Backslash Security are among the eldest in the group, especially in the cybersecurity sector, which is mostly composed of recent graduates from the IDF. Shahar Man, 46, and Yossi Pik, 50, met while working at SAP. They parted ways but continued to dream of the startup they would establish, which they accomplished in 2022. Man left the unicorn Aqua Security, where he was a founding team member, while Pik sold his startup, Farmigo, which supplied agricultural produce directly to consumers.

Backslash, which has been causing quite a stir in the cyber sector, seeks to solve the problem that Man and Pik themselves experienced as developers: identifying security weaknesses in the development stage of applications. Although this may not seem like a new area, like many cases in cybersecurity, existing solutions often identify problems but developers don't know how to address them, so they simply ignore them and continue working. Backslash's software identifies which weaknesses are indeed critical and which can be ignored.

Entrepreneur and investor Shlomo Kramer was the first to invest in Backslash alongside several VCs, and the company began selling the solution at the height of Israel’s war in Gaza. One of the major challenges for the young startup will be to compete with Endor Labs, a strong American rival that emerged at the same time but has raised much more money. Founded by Palo Alto alumni (not Israelis), Endor Labs came out of stealth mode with an extraordinary fundraising of $70 million, which will allow it to engage in very aggressive marketing. In order to compete head-on, Backslash will need to raise funds soon.

20. BRIA.ai

Sector: Artificial Intelligence | Established: 2019 | Founder: Dr. Yair Edato | Employees: 50 in Israel and the U.S. | Funding: $57 million from GFT Ventures, Intel Capital, Entrée Capital, Publicis Groupe, Getty Images, Samsung Next, IN venture, Atinum Investment, Z-Venture Capital (LY Corporation), Mirae Asset Venture Investment, J-Ventures

OpenAI has changed the tech world with ChatGPT and DALL-E, but this new technology has also raised questions about intellectual property rights. When software like DALL-E creates an image, it draws heavily on capabilities from images, photographs, and illustrations developed by others who hold rights to them. Israeli company BRIA.ai is developing an open-source platform for creating visual content for startups to address this challenge.

BRIA works in collaboration with visual content companies and holds licenses for over a billion images. This content is used to train basic text-to-image models sourced from BRIA's database, ensuring that original creators, artists, and media companies receive proper royalties for the images they contribute to the final product. The data attribution engine, which compensates content creators, mitigates the legal and ethical issues associated with the use of AI technology.

In conversation with Calcalist, founder and CEO Dr. Yair Adato explained what distinguishes BRIA from OpenAI. "Startups don't have access to the language models themselves, and if [they] want to continue developing them, [they’re] in trouble. We created an open platform that provides programmers with code, enabling them to develop new products themselves. We also don't allow the use of journalistic content, so [you] can’t generate images of figures like Bibi or Trump with our platform, thus preventing the spread of content that leads to misinformation and fake news. It is legally and socially secure. Unlike other companies in the field, I don't sell images but a platform which produces or loans images - I provide a machine that makes the ice cream and not the ice cream itself."

At the beginning of the year, the company completed a significant funding round of $24 million, which will enable it to commercialize its technology and generate revenue.

21. Foretellix

Sector: Autotech | Established: 2018 | Founders: Yoav Hollander, Ziv Binyamini, and Gil Amid | Employees: 180 in Israel, USA, Asia, and Europe | Funding: $135 million from 83North, FinTLv, Nvidia, Temasec, Volvo, NextGear, Isuzu

Israel has been among the leaders in autotech development for many years. Mobileye, which was sold to Intel for about $15 billion before being turned public again last year, is the most successful example, but alongside it, a whole industry of funds and companies in the field also flourished. In recent years, the number of new companies has decreased, with one standing out above all - Forertellix, which developed a solution for the automation of safety tests in autonomous vehicles and advanced driver-assistance systems (ADAS).

The company was founded by three veteran entrepreneurs who realized that one of the most difficult barriers to the development of autonomous systems is the issue of safety.

The platform developed by the company provides a unified process of verification and testing, combining real-world test drives and virtual simulations together on one platform. The platform helps developers, testing, and safety engineers at car manufacturers, as well as their assembly suppliers and autonomous vehicle suppliers, to better collaborate and increase efficiency in the development process of autonomous vehicle projects or ADAS systems.

At the end of 2023, the company completed a significant fundraising round that amounted to $83 million raised over two stages. The company has a long list of leading investors, among others also from the automotive and investment industry, including the Isuzu and Volvo car companies. These agreements guarantee the company significant revenues in the coming years and significant development potential in the automotive industry. The company recently announced the signing of a significant agreement with the Chinese car company Geely, which opens up the huge car market in China. Geely, which independently develops AI models as a basis for autonomous driving, will also use Forertellix’s platform to generate synthetic data for training and testing AI models.

22. Descope

Sector: Identity Management | Established: 2022 | Founders: Slavik Markovich, Dan Sharel, Guy Rinat, Rishi Bhargava, Aviad Lichenstadt, Meir Wahanon, Doron Sharon, and Gilad Shriki | Employees: 50, 30 of which are in Israel and 20 in the US | Funding: $53 million from Lightspeed, Notable Capital, Dell Capital, Cerca Partners, TechAviv, SVCI, Unusual Ventures, J-Ventures

The founders of Descope are no strangers to success and most of them were also among the founders of Demisto, which was sold in 2019 to Palo Alto Networks for $560 million. This time the founders chose not to establish another cyber company but to go after a different field, identities. Descope deals with the management of identities of everyone external to the organization, like suppliers and customers, rather than managing the internal identification. The focus is on new methods and not on passwords, such as biometric identification and also identification using Google, Apple, etc.

The company started by providing solutions to companies that wanted to easily add identification means to their application and later discovered that there is a whole market just waiting for them, that of corporate applications. There are many applications that customers have developed on their own and require users to log in every time.

Descope has developed one identification point that works with all applications and doesn’t require changing infrastructures. The company, which has existed for only two years, already has over 500 active customers. Today the company sells for several million dollars and soon it will already reach over $10 million in annual revenue.

Taking a long-term view, Descope opened a data center in the U.S. and another in Germany for its European customers. The company, which currently employs 50 people, is currently targeting mainly salespeople, having employed only two of them until recently. It now employs 10 with a focus on rapid growth.

When the company was first revealed, it announced one of the most significant Seed fundraising rounds of recent years - $53 million from several leading investors, including George Kurtz, founder and CEO of CrowdStrike; John W. Thompson, former chairman of Microsoft ; Bpul Sinha, co-founder and CEO of Rubrik; Assaf Rappaport, co-founder and CEO of Wiz; and Micah Kaufman, founder and CEO of Fiverr.

23. Qwak

Sector: Machine Learning | Established: 2021 | Founders: Alon Lev, Yuval Fernbach, Lior Penso and Ran Romano | Employees: 45 in Israel and the USA | Funding: $27 million from Bessemer Venture Partners, Leaders Fund, StageOne Ventures, and Amiti Ventures

Israel has always been a leader in building infrastructure for the technological world and less so in the consumer world. This also turns out to be the case in the world of artificial intelligence and machine learning. A good example of this is the startup Qwak which allows companies with data scientists to reduce significant parts of the infrastructure work required around the development of machine learning models and concentrate on the core of their work.

Although many companies invest extensive resources in establishing data teams, many of them fail to see the fruits of this investment and it does not influence the product and the company's performance.

The main reason for this gap is not necessarily challenges surrounding the development of the model itself, but rather the development of the surrounding infrastructures required to integrate the model into the production environment. In order to integrate models into the product environment, development teams and data science teams conduct a kind of "ping pong", which creates dependencies between the entities and extends the development and implementation period. Qwak's solution effectively neutralizes the dependence of the data science and development teams on each other and provides an organized and documented workspace that allows the process to be accelerated and the models to be managed as soon as they are integrated into the product environment.

Like many other companies in the field, Qwak also knows that this is the right time for it to charge forward with increased sales teams. In 2023, the company recorded sales of a few million dollars and according to estimates, in 2024, it will at least double its sales. In the coming years, similar to the companies that Nvidia has acquired in recent months, it is possible that Qwak will also become a target for acquisition by one of the giants in the field.

24. Frontegg

Sector: Enterprise Software | Established: 2019 | Founders: Aviad Mizrachii and Sagi Rodin | Employees: 70, in Israel and the USA | Funding: $70 million from Insight Partners, Pitango, Stripes, I3, Matias Ventures, Global Founders Capital

The company with the somewhat strange name Frontegg was founded by two former Check Point employees, Aviad Mizrachi and Sagi Rodin. At Check Point, they encountered a problem - for each application they developed, they had to build from scratch and redefine the management of customer identities and user access. The two decided to build a platform that would save developers of SaaS solutions a large part of the headache that accompanies development and founded Frontegg.

The decision to incorporate the word "egg" into the company's name stems from the fact that an egg symbolizes something new and also has a very strong shell from top to bottom. Since the establishment of the company, and with the proliferation of hacks resulting from the abuse of weaknesses in the field of identity management, the sector has only gotten stronger and has become one of the hottest in cyber.

Frontegg has large customers, including the German giant Siemens, alongside startups that are currently setting up their own systems. In total, the company has hundreds of customers, and last year it tripled its revenue, as well as the year before. There is no lack of competition, also in the form of Israeli rivals, including Descope, which was established a few years later, but raised quite a bit of money thanks to its veteran founders.

25. Sightful

Sector: Computing | Established: 2020 | Founders: Tamir Berliner and Tomer Kahan | Employees: 60, 58 in Israel, and the rest in the USA | Funding: $61 million from Aleph, Corner Ventures

Similar to foodtech, the world of augmented reality (AR) has been exciting humanity for many years, but the commercial successes to date have been few and far between. Many entrepreneurs tried their luck but without success. Sightful’s founders met at Magic Leap, the Israeli-American startup that was the closest to realizing the vision of augmented reality glasses, but its dream was also cut short. Armed with lessons learned from the Magic Leap experience, Tamir Berliner and Tomer Kahan are determined to succeed in their ambitious venture: a laptop without a physical screen.

Berliner, who was also one of the founders of PrimeSense, which was sold to Apple for $350 million, and Kahan, founded Sightful in 2020. The computer they built, the size of a normal laptop, is equipped with special glasses instead of a screen and enables the opening of dozens of virtual screens that can only be seen by those wearing glasses. In this way, it enables work in public places without jeopardizing privacy.

Taking a cue from Magic Leap, the ambitiously named Spacetop glasses are small and look almost like regular sunglasses. Those who need eyeglasses can get special lenses that are magnetized to the AR glasses. Sightful started selling its computer in the U.S. this year for $2,000. For now, it is only selling in small numbers and is still far from being commercial, with the main purpose at the moment being to get feedback from new users.

26. OneStep

Sector: Healthtech

Funding: $23 million from Aleph, 10D, Axon, Samsung Next, Altshuller Shaham, and Meitav Dash

27. Volumez

Sector: Enterprise software

Funding: $32 million from Koch Disruptive Technologies, Pitango, and Viola Ventures

28. Zenity

Sector: Cyber

Funding: $21 million from Intel, Upwest, Vertex, Gefen, and B5

29. Clarity

Sector: AI

Funding: $16 million from Walden Catalyst Ventures, Bessemer Venture Partners, Secret Chord Ventures, Ascend Ventures, and Flying Fish Partners

30. OneLayer

Sector: Cyber

Funding: $14.5 million from Grove Ventures, Viola, and KDT

31. Zero Networks

Sector: Cyber

Funding: $5 million from F2, Cyberark, Target Global, PICO Venture Partners, and Venrock

32. Prompt Security

Sector: AI

Funding: $5 million from Four Rivers, and Hetz Ventures

33. Obligo

Sector: Fintech

Funding: $55 million from 83North, HighSage Ventures, 10D, Entrée Capital, and MUFG

34. Bridgewise

Sector: Enterprise Software

Funding: $35 million from Mangrove, Psagot, Group11, and WIX

35. Protai

Sector: Healthtech

Funding: $20 million from Grove Ventures and Pitango Healthtech

36. Cycode

Sector: Cyber

Funding: $81 million from Insight Partners, and YL Ventures

37. Sedric

Sector: AI

Funding: $3.5 million from StageOne Ventures, Gefen Capital, Homeward, The Garage, and Ataboy Capital

38. Magnus Metal

Sector: Industrial Production

Funding: $88 million from Target Global, AWZ, Caterpillar, Cresson, Entrée Capital, and Deep Insight

39. Sweet Security

Sector: Cyber

Funding: $45 million from Glilot Capital Partners, Munich Re, CyberArk, and Evolution

40. Mitiga

Sector: Cyber

Funding: $45 million from Glilot Capital Partners, Cisco, ClearSky Security, Blackstone, Atlantic Bridge, Bamot, Samsung Next, DNX, and Redline

41. Port

Sector: Enterprise software

Funding: $25 million from Team8 and TLV Partners

42. Okoora

Sector: Fintech

Funding: Bootstrapped

43. Grip Security

Sector: Cyber

Funding: $66 million from Third Point Ventures, YL Ventures, Intel Ignite, and Strait

44. Gigablue

Sector: Cleantech

Funding: Unknown, from fresh.fund, At One Ventures, E44 Ventures, and Global Innovation Technology Ventures

45. IVIX

Sector: Fintech

Funding: $25 million from Insight Partners, Cardumen Capital, Citi Ventures, and Team8

46. GYTPOL

Sector: Cyber

Funding: Unknown, Bootstrapped

47. BRAVE

Sector: Adtech

Funding: Unknown, Bootstrapped

48. Remepy

Sector: Healthtech

Funding:

49. CarbonBlue

Sector: Cleantech

Funding: Unknown, from fresh.fund, Jibe Ventures, and Secret Chord Ventures

50. Zafran Security

Sector: Cyber

Funding: $30 million from Sequoia, Cyberstarts, Cerca, and PennyJar

This is the 16th year that Calcalist has ranked the top 50 private technology companies in Israel. For this purpose, we turned to a number of prominent investors, consultants, and entrepreneurs in the Israeli market. We asked the participants to pinpoint the startup companies that are growing, making money, that have the greatest momentum, and the highest chance of making a substantial business step in the coming year, while emphasizing companies that are not in their portfolios. After weighing the data and the variety of opinions collected from the best experts, the reporters and high-tech editors of Calcalist, who are well acquainted with the behind-the-scenes of these fields, compiled the list of the 50 most promising private technology companies in Israel.

This year’s ranking contributors are:

10D | Aleph | Amiti Ventures | Arieli Capital | Blumberg Capitel | Clal-Tech | Dell Capital | Entree Capital | F2 | FinTLV | Firstime | Gefen Capital | General Atlantic | GGV | Glilot Capital Ventures | Greenfield Partners | Grove Ventures | Hanaco | Hetz Ventures | Ibex Investors | IN Venture | INcapital Ventures | Index Ventures | Insight Partners | Intel Capital | Intel Ignite | J VENTURES J | JVP | KDT | Key1 | Lool Ventures | Merlin Ventures | Meron Capital | NFX | Notable Capital | OneStage | Peregrine Ventures | Pitango | Pitango First | Qumra Capital | Red Dot Capital | Remagine Ventures | State of Mind Ventures | Square Peg | Team8 | Third Point Ventures | TLV Partners | Upwest | Viola Growth | Viola Ventures | YL Ventures

First published: 09:22, 13.05.24