Israel's Generative AI map rapidly growing

Israel currently ranks as the third-largest Generative AI venture capital ecosystem globally, boasting an impressive investment influx of over $2.2 billion in the last three years. Viola Ventures' Alex Shmulovich highlights shifting trends, emphasizing incumbent dominance in horizontal applications and vertical startups' rise with industry-specific solutions

In a rapidly evolving landscape, Israel is solidifying its position as a key player in the dynamic realm of Generative AI, with the potential to reshape industries on a global scale. Alex Shmulovich, Principal at Viola Ventures, highlights this trend in a recent blog post.

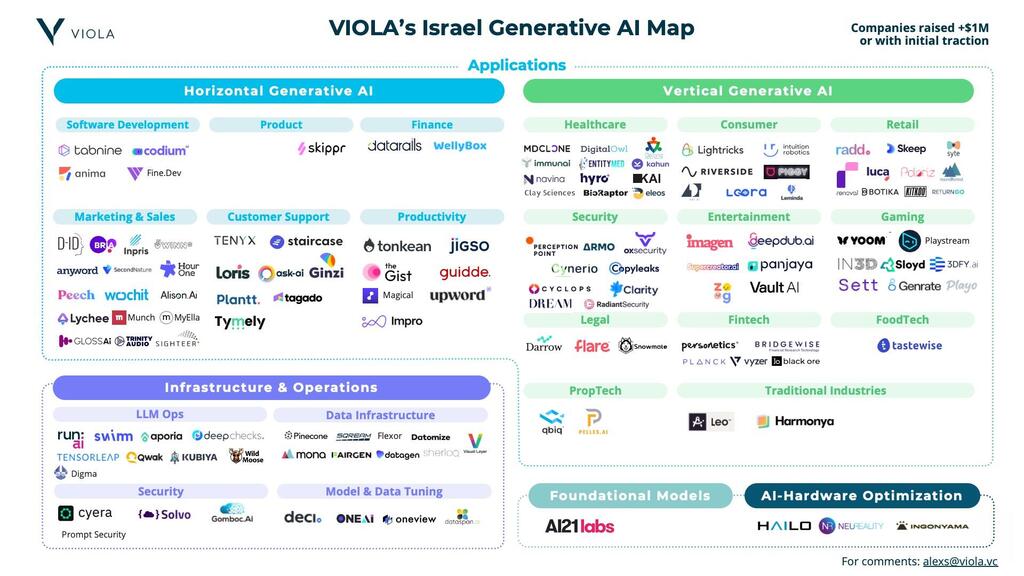

According to Shmulovich's report, Israel currently ranks as the third-largest Generative AI venture capital ecosystem globally, boasting an impressive investment influx of over $2.2 billion in the last three years. Over 130 companies in the country have either secured funding or demonstrated initial signs of traction, leveraging the core capabilities of Generative AI.

Despite the overall success of the Israeli Generative AI ecosystem, there have been indications of a slight slowdown. The launch of chat.gpt 3.5 in November 2022, while a significant milestone, has yet to trigger a substantial local investment surge. This could be attributed to a general deceleration in local venture capital and economic activities. Additionally, Israel's strategic focus on emerging categories has contributed to a measured pace in deploying Generative AI capital.

Shmulovich, who is leading investment in deep tech and AI-based companies at Viola Ventures, points out that recent geopolitical events, particularly the war in Q4-2023, have further impacted the tech investment landscape, leading to an overall slowdown in economic activities. Nevertheless, Generative AI investments are poised to set new records in the current quarter. Notable examples include Eleos Health securing a remarkable $40 million in a Series B funding round and Black Ore, an autonomous accounting solution, raising an unprecedented $60 million in the largest seed round for an AI application company globally.

As Israel navigates through challenges and maintains its commitment to cutting-edge innovation, the nation's Generative AI sector is anticipated to play a pivotal role in shaping the future of technology and business on a global scale. According to Shmulovich, as the landscape of Generative AI startups in Israel continues to evolve, predicting its dynamic trajectory proves challenging. However, discernible trends are shaping the future, providing crucial considerations for founders navigating this ever-changing space.

A significant trend is the gradual dissipation of the Generative AI application layer, a shift propelled by SaaS companies seamlessly integrating Generative AI into their core products. For founders, the challenge lies in strategizing how to outmaneuver incumbents, particularly those well-positioned to pioneer Generative AI add-ons.

In the realm of horizontal Generative AI applications, incumbents emerge as formidable contenders. With ownership of vast datasets, superior access to established client bases, and the inherent ease of integrating Generative AI layers into product features, these incumbents are set to dominate. While horizontal application startups may benefit from a less restrictive entry landscape, they face intense competition, making differentiation a daunting task.

Horizontal AI applications, specifically those augmenting or supplanting human-powered services, are anticipated to thrive, especially in areas where traditional SaaS and AI solutions are lacking.

Conversely, vertical Generative AI startups are poised for prominence by delivering tailored, industry-specific solutions. These startups not only carve out distinct niches but also justify higher Average Contract Values (ACVs), positioning themselves to capture market share from generic horizontal counterparts.

In the realm of AI infrastructure, Cloud Service Providers (CSPs), AI Model Providers, and Developer Platforms emerge as dominant forces. Bolstered by innovation, substantial funding, and strategic commercial positioning, these entities collectively steer the trajectory of Generative AI corporate adoption.

Within the densely populated AI Infrastructure startup landscape, differentiation becomes paramount for startups seeking to stand out. Opportunities for distinctiveness abound in areas such as data pipelines, observability, high-performance databases, and solutions for low-level AI chipset optimization, to compete with Nvidia’s Cuda, the leading AI chipset developer toolkit.

Shmulovich suggests several notes on what it takes for startups to thrive: Founders with strong product capabilities who are customer-centric and able to adapt the product in a highly dynamic environment; Significant technology on top of Generative AI capabilities, transcending simple API or UX innovation; Flexible architecture supporting multi-models and leveraging AI Agents. A clear advantage over CSPs and Model Providers in a less crowded space; AI applications that have the potential to replace knowledge-based human services requiring real-time interaction; Clear ideal customer profile (ICP) and competitive advantage over human services, SaaS, and AI alternatives; and methodology creating dependencies and stickiness among users.