The $660 billion question: When does AI pay back?

Earnings season exposes a widening gap between soaring capex and uncertain revenue.

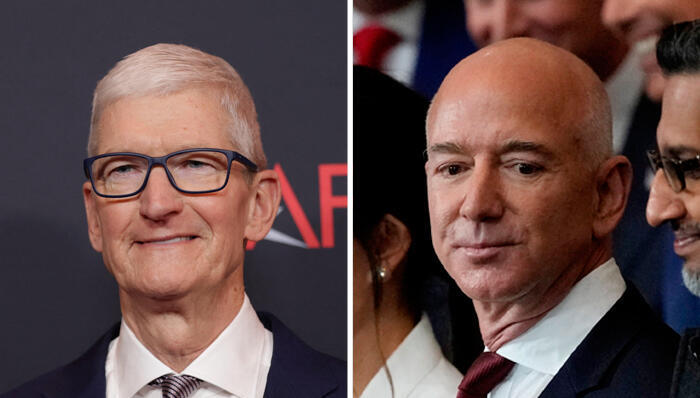

The latest quarterly reports from the tech giants, published over the past two weeks, have made investors realize something important: not only do these companies have no intention of slowing their investment in AI infrastructure, they plan to significantly increase it, perhaps even double it. Yet as returns on those investments remain elusive, fears of an AI bubble are resurfacing, and investors are beginning to panic. The result has been a sharp decline in the shares of Microsoft, Amazon, Google, and Meta in recent days. The only exception is Apple, whose AI infrastructure spending is far lower and whose stock has actually risen. Could Apple’s cautious and conservative approach once again prove wise after the dust settles?

By the end of the week, following Google’s earnings release, the projected scale of AI infrastructure investment by the tech giants for the coming year became clear. This includes data centers for training and running AI models as well as supporting systems such as electricity supply. In total, the companies estimate they will invest more than $660 billion in AI infrastructure in 2026, a 75% increase over 2025. And if 2025 is any guide, that figure could rise further.

Amazon, the largest cloud provider, leads the pack with expected investment of $200 billion, a 66.5% jump. Google follows closely with up to $185 billion, more than double last year’s level. Meta anticipates an 87% surge to $135 billion. Microsoft’s fiscal year does not align with the calendar year, so it has not issued a full forecast for 2026, but analysts expect its spending to grow more than 56% to around $130 billion. Apple does not publish capital-expenditure forecasts, yet analysts estimate its relatively modest investment will rise only about 10% to $13.4 billion.

The market reacted nervously: over the past five trading days Microsoft fell 3.7%, Amazon 14%, Google 7%, and Meta 6.7%. Apple, by contrast, gained 3.2%.

Over the past three years, since the AI revolution began with the launch of OpenAI’s ChatGPT, investors have rewarded the tech giants that poured billions into the field, believing the remarkably useful new tools would eventually produce revenue models to justify the spending. That optimism carried well into 2025, even as questions mounted about whether AI could generate income that exceeded its enormous costs.

Events such as the massive funding rounds for OpenAI and Anthropic, Elon Musk’s decision to fold xAI into SpaceX, and OpenAI’s controversial move to introduce advertising into ChatGPT underscored how far the industry remains from financial equilibrium, let alone profitability.

Those concerns reached a tipping point with the latest earnings reports and the realization that AI investments are not stabilizing but accelerating at double-digit rates - with no clear business model in sight. After three years of anticipation, investors are demanding proof that this copycat spending will eventually lead to profits. “The bar for tech giants is very high,” Seana Smith, an investment strategist at Global X, told CNN. “Markets reward AI investments only when they are linked to clear and consistent revenue growth.”

Among the tech giants, Apple is the only company that has not truly benefited from the AI boom. It had little significant AI activity before ChatGPT’s launch, and its response was hesitant and uneven. Efforts to adapt Siri to the AI era have struggled, while promised products were delayed or canceled. Even today Apple lacks an AI assistant that matches the capabilities of its rivals. Unlike others, Apple did not dramatically accelerate infrastructure spending, in the last quarter of 2025 its investment actually fell 19.4% year-on-year, and it has scaled back independent development in favor of cooperation with Google.

This weakness weighed on Apple’s stock relative to peers. Now, however, its conservative strategy is being reinterpreted as an advantage: it has no vast AI infrastructure to maintain and can benefit from others’ breakthroughs without bearing the costs. All the upside of AI, with fewer of the downsides. This is a familiar pattern: Apple’s refusal to chase noisy trends often looks misguided in the short term but proves prescient over time.

The sell-off in the tech giants spearheading the AI revolution has been accompanied by an even steeper decline in software and cloud-services companies, now viewed as potential victims rather than beneficiaries. Salesforce has lost roughly 25% of its value in the past month, while legal-services and research providers such as LegalZoom, LexisNexis, and Thomson Reuters have fallen as much as 20% in the past week.

“The consensus on software companies has flipped, they are now seen as victims, not beneficiaries, of AI,” said Steve Sosnick, chief strategist at Interactive Brokers. “The rising tide of AI lifted many boats. Now Wall Street is being forced to decide who the real winners and losers are.”

On the surface it seems paradoxical: how can the giants that are eating the lunch of software companies not get fat from the meal? Again, the problem is the business model. AI systems can perform many tasks once handled by dozens of specialized products, using a single tool instead of many licenses. The new plugins Anthropic unveiled for Claude, aimed at legal work, research, and analytics, illustrated this perfectly and helped trigger the recent sell-off.

For customers, this is a bargain: one subscription instead of dozens. For traditional software firms it is disastrous, and for AI providers it is only marginally better, they win the clients but capture only a fraction of the previous spending while bearing far higher costs to train and run models. In this scenario, both sides lose.

So who is winning, at least for now? The “old economy.” According to the New York Times, while technology stocks have stumbled, shares in energy, consumer goods, and materials companies have risen more than 10% over the past year. “After years of technology-led markets, the balance of power is shifting,” Angelo Kourkafas of Edward Jones told the paper. “Investors are moving toward traditional sectors.”

Not everyone accepts this narrative. “"There's this notion that the tool in the software industry is in decline, and will be replaced by AI... It is the most illogical thing in the world, and time will prove itself,” Nvidia founder Jensen Huang said last week. J.P. Morgan analyst Mark Murphy added: “The expectation that every company will replace every layer of mission-critical software with bespoke AI is irrational.”