Inside Zim’s $4.2 billion high-stakes sale to Hapag-Lloyd

A takeover at a premium valuation raises questions about jobs, security and maritime independence.

The sale of Israeli shipping company Zim to German shipping giant Hapag-Lloyd and Israeli investment fund FIMI, first revealed by Calcalist, continues to generate significant waves.

Calcalist has learned that Zim’s valuation in the deal stands at $4.2 billion, compared with its current market capitalization of approximately $2.7 billion on the New York Stock Exchange (NYSE), from which it will be delisted upon completion of the transaction. Zim currently holds $2.8 billion in cash. Part of that amount could potentially be distributed as a dividend prior to closing, which would reduce the net value of the deal. According to sources, disagreements have emerged on the board between veteran directors and recently appointed ones: the former oppose distributing a dividend as part of the transaction, while the latter support it.

Formally, the acquisition agreement will be signed between Zim and Hapag-Lloyd, which won the tender managed by Rothschild & Co on behalf of the board. Hapag-Lloyd will subsequently sign a separate agreement with FIMI to sell it Zim’s Israeli operations.

In practice, Zim’s international operations, including 99 chartered vessels, key trade routes (primarily between Asia and the United States), customer contracts and the Zim brand outside Israel, will be transferred to Hapag-Lloyd.

FIMI will retain the Israeli-focused activity, which will include 16 vessels owned by Zim, the national routes to and from Israel, the company’s headquarters in Haifa, and the rights and obligations stemming from the state’s golden share.

FIMI is expected to establish a new company informally referred to as the “new Zim.” The likelihood that current CEO Eli Glickman will continue in a senior role in the new entity is considered low. FIMI plans to base the new company’s business model on medium-sized container vessels rather than mega-ships.

Under agreements between the parties, Hapag-Lloyd will allow the new Zim access to sailing slots within alliances in which it participates, primarily on Mediterranean-U.S. routes. The new company will also gain access to Hapag-Lloyd-operated ports in Morocco, Italy and two ports in Egypt, including one on the Suez Canal.

The split structure is designed to address the limitations imposed by the state’s golden share, which prevents exclusive foreign ownership of a company deemed strategic or essential to Israel.

This issue is further complicated by Hapag-Lloyd’s shareholder structure: Saudi Arabia holds 10.2% of the company through a sovereign investment arm, and Qatar holds 12.3% through a similar vehicle. As a result, FIMI will hold the Israeli entity and assume responsibility for fulfilling the obligations derived from the golden share, including safeguarding Israeli interests during emergencies.

Despite the structure, Israel’s Administration of Shipping and Ports has issued a sharply critical position paper. In a document authored by the Authority’s director, Capt. Zadok Redker, he warns that while the split formally complies with golden share requirements, it could leave the Israeli company too weak to survive an expected industry downturn.

“If protective mechanisms such as state subsidies, guarantees, supplementary revenue streams or a government safety net are not established,” he wrote, “there is a high probability that in the near term Israel will find itself without a fleet, without seafarers and without independent maritime transport capacity, neither in routine times nor in emergencies.”

Redker argues that the global liner shipping industry is heading toward a deep downturn following the peak years of 2021-2022, when massive numbers of vessels were ordered. A return to shorter routes via the Bab el-Mandeb Strait and the Suez Canal, instead of detours around the Cape of Good Hope, would increase effective capacity and exacerbate existing oversupply.

The likely result, according to the Administration, would be falling freight rates, shrinking profitability and renewed losses for carriers lacking scale advantages. In this scenario, the “new Zim,” a smaller, local operator without global deployment or cross-subsidization capabilities, could face liquidity stress and even insolvency.

“The collapse of the new Zim would have devastating national implications,” Redker warned, including the loss of a national fleet available in emergencies, the disappearance of Israeli seafarers and officers, and the erosion of critical maritime capabilities. Rebuilding such capacity could require billions of dollars and 7-10 years of personnel training.

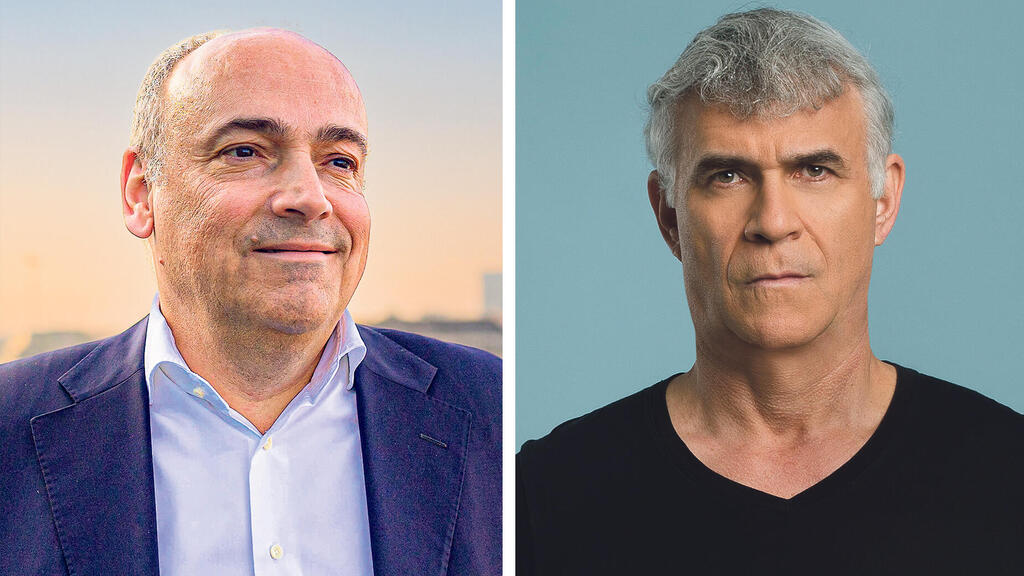

FIMI, led by Ishay Davidi, disputes this pessimistic outlook and believes it can stabilize the new Zim and restore profitability.

Zim’s board, chaired by Yair Seroussi, met yesterday in a lengthy session that lasted late into the night to approve the deal. Hapag-Lloyd reported to the Frankfurt Stock Exchange, where it is valued at approximately €20 billion, that it is in advanced talks to acquire Zim.

Hapag-Lloyd CEO Rolf Habben Jansen is expected to visit Israel to meet management and employees. However, tensions escalated when a meeting between management and the workers’ union collapsed. According to employees, they were told that only about 120 of Zim’s roughly 1,000 employees would remain with the new Zim under FIMI, with one year of job security and a bonus equivalent to four months’ salary. The workers’ union chairman halted the meeting and sent employees home. Further negotiations are expected.

Hapag-Lloyd denies plans for broad layoffs, stating that most employees not absorbed by the new Zim would be integrated into its Israeli operations, including a planned local branch and a marine technology R&D center that would consolidate Zim’s approximately 250 technology employees. The company notes that in previous mergers over the past two decades, most employees were retained.

Even after signing, the deal faces significant regulatory scrutiny. The Government Companies Authority has demanded full details of the transaction and emphasized that its approval is required under the golden share provisions, including the state’s right to requisition at least 11 vessels during emergencies.

In addition, approximately ten security and regulatory bodies, including the Israel Police, Shin Bet, National Security Council, the Director of Security of the Defense Establishment and the Mossad, are expected to submit opinions before the matter reaches the ministers of transportation, finance and regional cooperation for final approval.

The Authority is also insisting on a clear separation between Hapag-Lloyd and the new Zim, without side agreements between them.

If completed, the deal would represent a major win for Israeli institutional investors More Provident and Pension (2.9%), Reading Capital (1%) and Sparta, the investment vehicle of Plus500 co-founder Alon Gonen. These investors had opposed a previous $2.4 billion acquisition proposal backed by CEO Glickman and pushed for board changes and a dividend distribution.

Their pressure led to new board appointments and ultimately to the current sale at a significantly higher valuation. They are expected to generate tens of millions of dollars in gains if the transaction closes. Glickman himself, who holds 1.2% of Zim, stands to receive approximately $43 million.

Another beneficiary is Samer Haj-Yehia, former chairman of Bank Leumi, who is expected to receive several million dollars for advisory services related to structuring the sale.